Bain introduced the concept of the condition of entry’, which he defined as the margin by which established firms can raise their price above the competitive price level persistently without attracting entry.

Symbolically we have:

E = PL – PC / PC

Where E = ‘condition of entry’

ADVERTISEMENTS:

PL = limit price

PC = competitive price, that is, price under pure competition in the long run (PC = LAC).

Solving for PL we find

PL = PC (1 + E)

ADVERTISEMENTS:

Thus the condition of entry, E, is in fact the premium accruing to the established firms in an industry from charging a price, PL, higher than the pure competitive price, Pc, without attracting entry. The time period which is implied in the above definition of the ‘condition of entry’ is ‘long enough to encompass a typical range of varying conditions of demand, factor prices, and the like. This period normally might be thought of as 5 to 10 years’, Bain argues.

Given that Bain concentrates on entry by new firms, ignoring cross-entry, as well as the effects of take-overs on pricing behaviour, and of the expansion of capacity by existing firms, entry in his theory is a long-run phenomenon. The lag of entry is an important determinant of the barriers to entry. For example, the establishment of a firm in women’s garments may require four months, in cement one to two years, in liquor four to five years. The longer the lag, the less the threat of entry and hence the greater the gap between the limit price PL and the competitive price Pc.

The lag of entry, that is, the time required for a new firm to be established, depends on various factors which constitute the barriers to entry.

Bain distinguishes four main barriers to entry:

ADVERTISEMENTS:

(1) Product-differentiation barrier, or preference-barrier.

(2) Absolute- cost advantage of established firms.

(3) Economies of scale.

(4) Large initial capital requirements.

One could add to this list the legal barriers to entry which are imposed by law. These, however, are exogenous and if they exist entry is blocked. The firms protected by such legal barriers may charge any price without the fear of attracting new entrants. We will examine Bain’s barriers in some detail and present Bain’s main empirical findings on the actual importance of these barriers in the real world.

Product-differentiation barrier:

Some aspects of product differentiation were discussed initially by Chamberlin and subsequently by other writers. Traditional theory stressed the following consequences of product differentiation. Product differentiation gives to the firm a degree of control on the price of its product. Product differentiation is also the reason for advertising and other selling activities, which actually aim at intensifying the differences between a firm’s product and the products of competitors. Such expenses clearly affect both the demand and the costs of the firm.

Furthermore, product differentiation results in internal organisational changes of the firm. Thus large firms have to set up special sales departments to organize the promotion and distribution of their products. Finally product differentiation also has some effect on the concentration of firms and on industry structure.

What was completely neglected in traditional theory was the importance of differentiation for entry. The preferences of buyers, attached to various existing brands, clearly create a barrier to the entry of a new firm. An entrant is at a disadvantage because he has to make his product known and attract some of the customary buyers of the product of other established firms.

ADVERTISEMENTS:

To surmount this goodwill or preference barrier a new firm must either offer its product at substantially lower price than the established firms, or do heavier advertising (and other selling activities) or both. Such activities lead to higher costs in the new firm and can formally be analysed on the same lines as the absolute cost advantage barrier, assuming that at all levels of output the new entrant will always have a higher cost. But even if the new firm manages to establish itself and reach a scale and a price-cost position similar to that of the established firms, the losses incurred at the initial stages of establishing goodwill will never be recovered.

Bain, in his monumental study of twenty manufacturing industries has found that the product-differentiation barrier is the most serious barrier to entry. It is more important for the modern differentiated oligopoly which produces branded consumer commodities and to a smaller degree for those industries that produce branded producers’ goods (machinery).

The strength of this barrier depends firstly on the size of advertising and other selling expenses required for establishing goodwill; secondly, on the durability and complexity of the products; in purchasing durable or complex goods the buyer relies more on reputation and information from friends who have used the commodity; to acquire a similar reputation the new firm needs a long time and heavy promotion expenses.

The strength of this barrier depends also on the method of distribution of the commodity; if established firms use ‘exclusive arrangements’ practices with wholesale dealers the new entrant is faced with increased difficulties. Finally, this barrier is influenced by the importance of ‘conspicuous consumption’; if established products have a ‘prestige’ reputation a new entrant will have increased difficulties in his effort to establish himself.

ADVERTISEMENTS:

In particular Bain’s empirical findings regarding the preference barrier may be summarized as follows:

Very important preference barriers were found in five industries (automobiles, cigarettes, liquor, tractors, and typewriters) and in some lines of expensive fountain pens and heavy farm machinery. Moderately important preference barriers were detected in four industries (tyres, soap, petroleum refining, metal containers), and in specific lines of another three industries (some canned fruit, flour sold branded to consumers, expensive branded shoes).

In the remaining industries (general canned goods, cement, copper, gypsum products, simple farm machinery, flour, cheap fountain pens, meat packing, rayon, low-price shoes, steel) preference barriers were negligible. These findings are not surprising given the fact that Bain examines the difficulties of entry by completely new firms. However, the importance of the preference-barrier is greatly diminished if one adopts the view of the typical entrant, which is a firm already established in an industry (cross-entry or within entry) and already has built up its own goodwill.

Furthermore, product differentiation works also in the opposite direction it encourages entry. Given that in the modern industrial world the main weapon of competition is product innovation, a firm can count on producing and establishing a new-styled product, if it decides to enter a particular market, by adopting similar tactics as existing firms.

ADVERTISEMENTS:

Absolute Cost Advantage:

Absolute cost advantage may arise from the following situations:

(a) Skills of expert management personnel. A completely new firm usually has difficulties in recruiting trained managerial personnel and ordinarily it has to pay a higher salary in order to attract managers away from other firms,

(b) Patents and superior techniques (know- how) available only to the established firms,

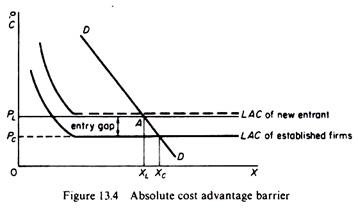

(c) Control of the supply of key raw materials. In this event, the entrant must either pay a higher price for the acquisition of such materials or he will be coerced to use inferior substitutes. In both cases the advantage of established firms is an indisputable fact, and the cost curve of the entrant will lie above the cost curve of the established firms at all sizes of output (figure 13.4).

(d) Lower prices for raw materials due to exclusive arrangements with suppliers or because of bulk-buying by the (large) established firms.

ADVERTISEMENTS:

(e) Lower cost of capital for the established firms. A new firm may have to pay a higher interest rate for obtaining the capital required for its setting up. Established firms have access to some internal financing or to the capital markets at relatively favourable terms as compared to a new firm.

(f) Lower cost due to the vertical integration of the production processes of established firms. If the entrant is to achieve the same advantageous cost structure, he will have to enter with a fully integrated productive unit, and the absolute capital requirements for setting up such a complex organisation may create an absolute barrier to entry (see below), and not merely an absolute cost disadvantage for the entrant.

If any type of absolute cost advantage exists the LAC of the entrant will be higher at every scale of production than that of the established firms (figure 13.4).

The entry-preventing price, PL, will be set at a level just below the cost of the potential new entrant. The entrants demand is AD, that is, the part of the market demand to the right of XL. The section AD of the market demand lies below the LAC of the entrant and hence entry becomes impossible, since the entrant cannot cover its costs at any level of output.

The difference PL – Pc is called the entry gap and shows the amount by which established firms can raise their price above their costs, that is, above the competitive price Pc, without attracting entry. (Recall that the condition of entry is defined as the ratio of the entry gap over the competitive price.)

ADVERTISEMENTS:

From his empirical studies of twenty manufacturing industries Bain found that in general absolute cost barriers are less important than those arising from product differentiation or from economies of large- scale production. Slight absolute cost barriers commonly result from the difficulty of entrants in acquiring skilled managers and know-how. Ordinarily this barrier to entry would be reflected in ‘shake-down losses’ for a very limited time, or in slightly higher costs for a few years. Less frequent were barriers from patents or from control of key resources.

Bain found that in four industries (steel, copper, automobiles, petroleum refining) backward integration by the entrant was necessary to avoid a serious absolute cost disadvantage. In two industries (copper, steel) substantial cost barriers were found. These were due to close control of existing resources. Similarly, in the industry of gypsum products absolute-cost-advantage barriers were very important due to patents and secrecy in know-how. In the remaining seventeen industries absolute cost barriers were very slight.

Two points should be stressed with respect to the absolute-cost-advantage barrier. First, the absolute-cost-advantage barrier loses its significance if the entrant is an already-established firm in the same industry (intra-industry entry or within-entry) or in another industry (cross-industry entry or cross-entry).

Such firms-entrants have their own trained managerial team, their own know-how, their own sources of supply, easy access to internal and external sources of finance, and will be already vertically integrated if this is advantageous. Patents or ownership of a key resource may still be barriers, but may also be an advantage if the entrants have the patent, or the key resource, or have hit upon an improved method of production. Secondly, if the entrant is a completely new firm, it has two advantages over existing firms.

A new firm can plan its plant de novo (from scratch) and adopt the most up-to-date methods of production, while established firms have some old machinery, which cannot normally be scrapped completely in the short run. In addition, a new firm has absolute freedom to choose the location of its plant and its distribution channels, a choice which is not open to the already established firms (at least in the short run). These factors may significantly reduce or eliminate any other cost advantage that the established firms might enjoy.

Barrier from initial capital requirements:

ADVERTISEMENTS:

To set up a new business one needs an initial capital outlay, whose amount depends on the technology of the industry in which entry is being considered. One might argue that new firms have difficulties in securing the required initial amount of capital. Banks may be reluctant to finance a new business, and the capital market is almost inaccessible to a new firm which has not built up a reputation. If such a new entrant can secure the capital required, most often he will have to pay a higher interest rate than the established firms, and in this case he will have an absolute cost disadvantage.

This, however, may be overcome in the long run if the firm succeeds and reaches the size that has the same costs as the established firms. However, in some cases it may be impossible for a new firm to obtain finance at any interest rate. In this case the initial capital requirement creates an absolute entry barrier, which is more probable if the amount of capital initially required is large.

From his empirical studies Bain found that absolute capital requirements have been important in five industries (steel, automobiles, petroleum refining, tractors, cigarettes), and somewhat less important in another five industries (rayon, liquor, cement, tyres, soap). Bain could not classify three industries (copper, farm machinery, typewriters) due to lack of sufficient information. In the remaining industries Bain did not find any significant barrier raised by absolute capital requirements (meat packing, fountain pens, metal containers, gypsum products, canned goods, flour, shoes).

We should like to point out that Bain’s findings are not surprising given his concentration on the entry of new firms. Clearly, if the entrant is an already-established firm, it will not have difficulties in securing the finance required for expansion, either from internal funds or from the capital market. Furthermore, the widespread diversification and conglomerate movement facilitates the finance of a new firm or a new venture within the conglomerate the finance requirements are most often provided by other member-firms of the conglomerate.

Economies of scale:

Economies of scale may be real (those which reduce the inputs of factors per unit of output) or pecuniary (those which result from paying a lower price for the inputs purchased by the firm). The latter do not reduce the quantity of inputs, but rather the money cost of the inputs for the particular firms.

ADVERTISEMENTS:

Real economies are technical (resulting from using more efficient large-scale machinery), managerial (resulting from spreading the managerial fixed input over a larger amount of output) and labour economies (arising from the greater specialization of labour).

Pecuniary economies arise from bulk-buying at preferential lower prices; lower transport costs achieved when output is large; and lower advertising and other selling costs per unit of output. Whatever their nature economies of scale, whenever present, do form an important barrier to entry for new firms.

The analysis of this barrier is not as simple as the previous ones, because the effects of the economies of scale on the level of the limit price depend on the expectations of entrants about the reactions of established firms after entry, as well as on the expectations of the established firms about the behaviour of entrants. Various reaction patterns may arise. Bain cites six possible categories of conjecture by potential entrants.

Firstly:

The potential entrant expects that established firms will keep the price constant post-entry.

Secondly:

The potential entrant expects that established firms will retain their output constant at the pre-entry level.

Thirdly:

The potential entrant expects that established firms will partly reduce their output and will allow the price to fall, but by less than in the previous case.

Fourthly:

The potential entrant expects ‘retaliation’ by the established firms, that is, he expects that existing firms will increase their pre-entry output, thus effecting a greater fail in price than in the second case.

Fifthly:

The entrant expects that established firms will substantially reduce their quantity of output so that the price rises above the pre-entry level.

Sixthly:

The entrant expects that his entry will be ‘unnoticed’, because he enters at an insignificantly small scale. Thus he expects that the existing firms will change neither their quantity nor allow a change in the market price.

Bain states that the most probable conjecture is the third one, in which the entrant expects that the existing firms will partly reduce their output and will also allow the market price to fall, thus partly accommodating the entrant. This is an intermediate conjecture between the first and the second cases. Thus Bain concentrates his analysis on the first two ‘limiting cases’ because in this way the content of the most likely third conjecture ‘is best understood by examining the two limiting cases which surround it’. The last three patterns of behaviour are not examined by Bain on the grounds that they are unlikely and unrealistic.

The following set of assumptions and definitions underlies Bain’s models:

1. For each industry there exists a minimum optimal scale of plant, that is, a minimum plant size at which the economies of scale are fully realized. We will denote the minimum optimal scale by x.

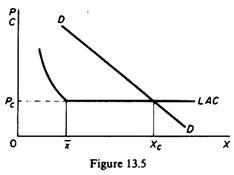

2. The LAC curve is L-shaped. Costs remain constant beyond the minimum optimal scale (figure 13.5).

3. The LAC is the same for all firms, the established ones and the potential entrant, since technology is the same for all. The advantage of the established firms is that they have already reached scales of output larger than the minimum optimal x, while the entrant will have to establish himself gradually, starting perhaps from suboptimal levels of production (x < x). In this event the entrant must be assumed to expect that he will eventually reach the minimum optimal scale x, otherwise he would not enter the market.

4. The flat part of the LAC curve determines the long-run competitive price, Pc, because price cannot remain below the LAC in the long run. Thus Pc = LAC (over the flat part of the long average-cost curve). The output corresponding to the competitive price, given the market-demand curve DD, is the competitive market size (or competitive output). It will be denoted throughout by Xc.

5. The market-demand curve DD is known to all firms, existing and potential entrants. That is, all firms know the price elasticity of the market-demand curve.

6. All firms produce very similar products, so that the price is the same for all competitors (actual and potential). This assumption isolates the scale-barrier from the preference-barrier. If the two co-exist, the one reinforces the other, so that the overall entry-barrier will be stronger.

7. All firms are assumed to have equal market shares. Although this is a simplifying assumption, it is not unrealistic given the earlier assumption of the homogeneity of the products of the firms. It is further assumed that the entrant will capture the same share as the existing firms, that is, the total market is equally shared between the old and the new firms.

8. The share of each firm is a constant proportion of the market demand at all price levels. Thus we may use a share-of-the-market-demand curve for the individual firm, which shows a constant share of the total market at all prices. The share-demand curve, denoted by d, has the same price elasticity as the market demand at all price levels.

Under the above set of assumptions we may use the individual LAC and dd curves to derive the equilibrium of the firm and the industry. In figure 13.6 the two graphs are drawn with different units of measurement for the quantity of output. The right-hand figure refers to the industry, with DD the aggregate demand curve and Xc the competitive output at Pc = LAC. The left-hand diagram refers to the individual firm. We may now turn to the examination of Bain’s models.