Why do different countries trade with each other? As trade benefits them, they trade with each other. Why does gain from trade arise?

The gain from trade arises because of specialisation in production and division of labour. Individuals specialise, firms specialise in certain products.

Same is true for the countries. That is why, each country is interested in exchanging its own specialised products for non- specialised products. But which products should a country specialise in? Classical economists answered this question.

According to classical writters, differences in cost form the basis of trade. Differences in cost may be two types: (i) absolute cost difference, and (ii) comparative cost difference. In 1776, Adam Smith argued that absolute cost difference or absolute advantage is the basis of trade.

ADVERTISEMENTS:

But another classical economist, David Ricardo, went a step forward in 1817 to search the basis of trade in terms of comparative cost difference or comparative advantage. Adam Smith argued that a country will export that commodity in which it has an absolute advantage and import that commodity in which it has an absolute disadvantage.

According to Ricardo, a country will produce and export that commodity in which it has a comparative advantage and will import that commodity in which it has a comparative disadvantage.

In explaining their trade theory, classicists made the following assumptions:

(i) There are two countries, two commodities and one factor; i.e., a 2 x 2 x 1 model.

ADVERTISEMENTS:

(ii) Labour theory of value holds. Classicists argued that labour is the only productive input as far as the value of a commodity is concerned. Value of a commodity is determined by the amount of labour embodied in it. Thus, production cost is measured in terms of labour costs only.

(iii) Production function obeys constant returns to scale. In other words, output per unit of labour is constant over all relevant ranges of the production function.

(iv) Inputs, although mobile domestically, are completely immobile internationally.

(v) Transport cost is zero.

ADVERTISEMENTS:

(vi) Free trade policy is pursued.

I. Adam Smith’s Absolute Advantage Doctrine: n

According to Adam Smith, it is the difference in absolute production cost that causes the emergence of trade. A country has an absolute advantage over another country in the production of a good if it can produce it at a lower cost.

It would, thus, be advantageous for the country if it specialises in the production of the cheapest good. Adam Smith argued that a country would produce and export that commodity in which it has an absolute advantage or lower cost and import that commodity in which it has an absolute disadvantage or higher cost.

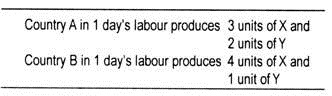

Following arithmetical example will help explain Smith’s absolute cost differences. Let us assume that there are two countries, A and B, that produce two goods, X and Y, which require labour for their production.

Further, suppose that country A takes 1 day’s labour to produce 3 units of X and 2 units of Y. Country B produces 4 units of X and 1 unit of Y by the same labour cost. Clearly, country A has an absolute advantage in the production of Y since it can produce it at a lower cost than country B. While country B has an absolute advantage in the production of X.

In the absence of trade (i.e., under autarky or no trade) in country A, 3 units of X will exchange for 2 units of Y and in country B 4 units of X will exchange for 1 unit of Y. Thus, internal and domestic exchange ratio between the two goods of country A is 3 : 2 and for B is 4:1. Country A will now benefit if it can produce and export good Y to buy more than 2 units of Y.

Similarly, country B will gain more by producing and exporting X from A by buying more than 4 units of X. Clearly, both countries will gain. Anyway, trade is mutually beneficial since it increases both production and consumption.

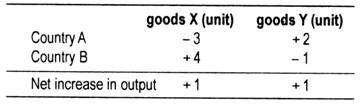

Because of trade, production of both X and Y will increase in the following pattern:

Thus, international trade is mutually beneficial. Global output and consumption of both X and Y have increased at least 1 unit in each country.

II. Ricardo’s Comparative Advantage Doctrine:

Ricardo has demonstrated that absolute cost advantage is not a necessary condition for two countries to gain from trade. Instead, he concluded that trade would benefit both nations if comparative costs differ. To him, comparative difference in cost is a sufficient condition for trade to emerge. Ricardo’s doctrine states that a country will export that commodity in which it has a comparative advantage and import that product in which it has a comparative disadvantage.

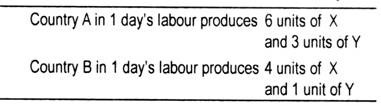

The following example suggests that (developed) country A has an absolute advantage in the production of both goods X and Y. Nevertheless, country A can gain from trade with the (less developed) country B because it has a cost advantage in the production of Y than in X. In contrast, (the poor) country B has a comparative advantage in the production of X. Pre-trade exchange ratios for A and B are 1 X for 2 Y (i.e., 6 for 3) and 1 X for 4 Y. In other words Y is cheaper in A while X is cheaper in B. So, A should export Y while B should export X, each specialising in that commodity in which it has a comparative advantage.

ADVERTISEMENTS:

Before trade, let us assume that country A transfers all labour from the production of X to the production of Y in which its pre-trade opportunity cost (1:2) is lower and country B shifts all labour from the production of Y to the production of X in which its pre-trade opportunity cost (1: 4) is lower.

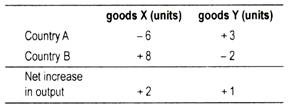

Now, country A enjoys low comparative cost in the production of Y while country B enjoys the same in the production of X. Labour will now be transferred form X-production to Y-production in country A while labour will be transferred from Y-production to X-production in country B. As a result, production of X will decline in country A by 6 units while production of Y will increase by 3 units.

At an international exchange rate of 1: 3 (lying between two domestic exchange rates of 1 : 4 and 1 : 2), country A will now export 3 units of Y and import 9 units of X. Before trade, country A consumed 6 units of X and after trade it consumes additional (9-6 = 3) units of X. This is called ‘gains from trade’.

Likewise, country B gains from trade. As country B transfers labour from Y-production to X-production, Y output declines by 1 unit. But, as labour is transferred to X-production, X-output rises by 4 units. Country B now trades with A at an exchange rate of 1: 3 by exchanging 1 unit of X for 4/3 = 1 1/3 units of Y. As a result of trade, country B consumes additional 1/3 units of Y. This is known as ‘gains from trade’.

ADVERTISEMENTS:

The result will be:

We have learnt that internal terms of trade is 1: 2 in country A and 1: 4 in B. Both countries will now gain from this specialisation in trade if exchange rate or post-trade terms of trade lies between two internal or domestic exchange rates, i.e., between 1: 2 and 1:4. Let the international terms of trade be 1:3.

At this new exchange rate, A will specialise in the production of Y. Now, by exporting Y, it will bring more X. As soon as country A transfers labour from X-production to Y-production and country B from Y-production to X-production, there occurs complete specialisation. This kind of specialisation results in more global output.

Thus, Ricardo’s comparative cost doctrine demonstrates the basis of trade, direction of trade and gains from trade.

Limitations:

This theory has been criticised on many grounds. Important criticisms against this theory are:

ADVERTISEMENTS:

(i) Unrealistic Assumption of Labour Theory of Value:

Firstly, one of the fundamental assumptions of the classical trade theory is the labour theory of value. This theory states that the relative costs of production are determinded by the labour cost alone. However, this theory of value had been discarded earlier.

Thus, the assumption of the labour theory of value seems to be unrealistic in explaining the cause of trade. Modern economists have discarded the labour theory of value and employed opportunity cost theory. Opportunity cost theory rescues Ricardo’s doctrine without altering its basic conclusion.

(ii) Differences in Comparative Cost not Explained:

Secondly, Ricardo could not explain why comparative costs differ between countries. Answer to this question was given by Eli F. Heckscher and B. Ohlin who suggested that differences in factor endowments and factor-intensity give rise to differences in comparative costs.

Let us assume that country A uses more capital in the production of a commodity than country B. If use of capital per unit of labour in country A is higher, then country A is a capital-abundant country. On the other hand, let us assume that country B is a labour-rich country. In our example, we have seen that country A specialises in the production of Y as it has comparative advantage in Y-production.

ADVERTISEMENTS:

Since country A is a capital-intensive country, Y-production here becomes more capital- intensive. Likewise, country B has comparative advantage in the production of X. Being a labour-rich country, country B’s production of X becomes more labour-intensive. Heckscher and Ohlin argue that a country will specialise in the production and export of goods whose production requires a relatively large amount of the factor in which the country is relatively well-endowed (i.e., more abundant factor).

As country A in our case is a capital-rich country, it specialises in the production of Y (comparative costs of Y are cheaper). Since country B is a labour-abundant country, its comparative costs are lower in X-production and, hence, its exports X for Y. Thus, differences in factor endowments and factor intensity explain differences in comparative cost. Ricardo simply took for granted that labour cost ratios differ.

(iii) Exact Terms of Trade Undetermined:

Thirdly, Ricardo could not determine the exact terms of trade or exchange rate at which trade takes place. Ricardo’s terms of trade (TOT) would lie between the countries’ pre- trade terms of trade; but the exact ratio was left undetermined.

This gap was filled by the classical author J. S. Mill by introducing the concept of ‘reciprocal demand’ in trade theory. Ricardo’s model concentrates on the supply (or cost) side and, hence, neglects the demand side.

(iv) Zero Transport Cost is Inconceivable:

ADVERTISEMENTS:

Fourthly, Ricardo neglects transport cost just for simplicity. It is true that transport costs are important in determining the exchange rate. Supporters of Ricardo’s doctrine have adequately demonstrated that transport costs do not affect comparative cost doctrine.

(v) Trade is Multilateral and Multigood:

Fifthly, another restrictive assumption of the classical trade doctrine is that it used two countries, two commodities and one input. But for simplicity, Ricardo’s model is 2 x 2 x 1 model. If we apply Ricardo’s theory in case of more than two countries and more than two commodities, conclusions of the doctrine remain virtually unaltered.

Conclusion:

In analysing his trade doctrine, Ricardo started with the unreal world. Some of the writers fit this theory in the real world without altering its fundamental conclusions. Some of his assumptions were questionable. Modern writers removed those assumptions and refined this doctrine. Only the gaps in the Ricardian model have been filled up by modern writers. A doctrine propounded at least 180 years ago is even now respected by all, possibly because of its originality.

Extending Ricardo’s Doctrine:

(i) Many Commodities but Two Countries:

ADVERTISEMENTS:

Ricardo’s doctrine has been criticised on the ground that the doctrine is confined only to two commodities and two countries. Critics argue that the doctrine has limited applicability since today’s trade is multilateral. Further, number of traded goods is not two but many.

But Ricardo’s disciples have successfully demonstrated that comparative cost doctrine can even be applied in the case of more than two commodities and more than two countries. Let us see how trade takes place when two countries trade with more than two goods.

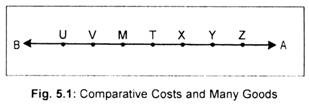

For simplicity’s sake, let us assume that there are two countries A and B which trade seven commodities. These commodities have been arranged in a comparative advantage sequence. Country A has the tendency to specialise in commodities on the right hand side of Fig. 5.1. Similarly, country B has the tendency to specialise in commodities on the left hand side of the diagram.

This means that country B has the greatest comparative advantage in the production of U-good, its advantage in Y or Z is not so large. If now trade opens up, B will export larger U-good and A larger Z-good. But what about other goods? Whether a country will export more of other commodities depends on the strength of international demand and the TOT.

If Y is demanded more by country B, then country A would specialise in its production and produce less in which it has a comparative disadvantage, say good V. Thus, comparative cost is again the basis of trade in the case of many commodities.

(ii) Many Countries but Two Goods:

The comparative cost doctrine is equally applicable in a multi-country model. Suppose, there are four countries A, B, C, D who trade with two goods X and Y. For simplicity’s sake, let B, C and D be described as a single group of countries. Thus, for convenience, we have two countries A and the rest of the world who trade goods X and Y on the basis of comparative cost differences. This assumption makes this extended Ricardian model into 2 x 2 model.

(iii) Multi-Countries, Multi-Commodities:

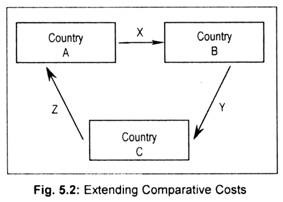

Ricardo’s doctrine has also applicability in a multi-country, multi-commodity framework. Let there be three countries A, B and C that exchange goods X, Y and Z with each other. Country A exports X to country B, country B exports Y to country C and country C exports Z to country A. The arrowheads in Fig. 5.2 suggest that trade is a one-way traffic. This means that no country export to another country.

But it is not so since export of one country is the import of another country. What is true is that country B pays A for its export good X in country C, country C pays B via country A and so on. Thus, trade takes place between many countries and many commodities.