The Liquidity Preference Theory presented by J. M. Keynes in 1936 is the most celebrated of all. According to Keynes, the rate of interest is a purely monetary phenomenon. It is the reward for parting with liquidity for a specific period of time.

Thus, like the price of a commodity, the rate of interest is determined by the demand for and the supply of money. It is, therefore, necessary to introduce the concepts of demand for money and supply of money.

The supply of money refers to the stock of money in circulation and is a fixed quantity at a particular point of time. It is the sum of currency (notes and coins) and commercial bank deposits. It remains fixed in the short rim because it is determined and controlled by the central bank of a country.

So it plays a passive role in interest rate determination. By contrast, the demand for money plays an active role in determining the equilibrium rate of interest. Therefore, a background knowledge of demand for money is essential in order to understand Keynes’ theory.

The Demand for Money:

ADVERTISEMENTS:

Wealth can be held in various forms— money, fixed interest securities (bonds), shares, property, jewellery, valuable paintings etc. Keynes first analysed, in detail, the reasons why people will hold wealth in the form of money.

At a fixed point of time, a certain stock of money is held, i. e., people wish to hold a certain amount of wealth in ‘liquid’ form. ‘Liquidity’ refers to the ease with which assets can be changed into cash without loss or delay. It is property which is enjoyed by all assets to some extent. Obviously money is the most liquid of all assets. The demand for money was, therefore, termed by Keynes ‘liquidity preference’.

J. M. Keynes gave three reasons for holding money the transactions motive, the precautionary motive and the speculative motive.

1. Transactions Motive:

ADVERTISEMENTS:

Individuals and business firms hold money in order to carry out day-to-day transactions.

Each individual or firm has a time gap between receipts (income) and payment (expenditure) and will need to hold money to cover this.

The average amount held will depend primarily on the system of payments, i.e., on the frequency of the receipts. For example, if a weekly paid person receives Rs. 300 a week and he has spent it all by the next pay-day, his average cash holding is Rs. 150, i.e., the amount he had at the beginning (Rs. 300) and the amount he has at the end (zero), divided by 2. If he receives monthly salary of Rs. 1,200 then, assuming that his spending habits do not alter, his average cash holding will rise to Rs. 600, i.e., (Rs. 1200 + 0) ÷ 2.

The amount of cash held for transactions and precautionary purposes also depends on incomes and prices. If income increases, then more money will be held. Similarly, if prices rise, more money will be required to purchase the same amount of goods and services.

ADVERTISEMENTS:

2. Precautionary Motive:

People and business firms hold some money as a reserve to meet unforeseen contingencies, such as sickness or accidents or the need to take advantage of an opportune to buy something which is being offered at a specially reduced price for only a limited period, e.g., during a sale.

3. Speculative Motive:

The classical economists considered it irrational for people to hold wealth in the form of money other than that held for transactions and/or precautionary purposes. It is because any money left over could be invested in interest-earning assets like bonds. Keynes, however, argued that it was not necessarily irrational to hold idle money balances.

He pointed out that at times it might be preferable to hold idle money (cash) than to buy government securities (bonds). If a person holds money, he loses interest but he does not suffer capital loss (due to fall in the value of his assets) either. In fact, it costs money to hold money. Therefore, the rate of interest is called the opportunity cost of money holding. By holding money an individual loses the opportunity to earn interest.

(Here we ignore the effect of inflation and leave aside any reduction there-from). By holding securities, however, he earns a fixed sum as interest, but its market value can (and does) vary. Therefore, in certain situations, money is preferable to securities. For example, if a person pays Rs. 100 for a Rs. 100 bond whose rate of interest is 10%, then at the end of the year he receives Rs. 10 (or Rs. 110 in all, i.e., including the principal). But if in the meantime the value of the bond has fallen to below Rs. 90, the loss on this amount more than offsets the interest.

The market value of a bond is inversely related to the market rate of interest. Thus, if the rate of interest goes up, the market value of a bond will fall.

The market value is shown in the following formula:

Market value = Original value x Original rate of interest Market rate of interest

ADVERTISEMENTS:

In the case of a Rs. 100 bonds whose original rate of interest is 10%, Rs. 10 interest will be paid at the end of the year. If the market rate of interest rises to 20% and the bondholder wishes to sell it for some reason, he will not find a buyer ready to give him Rs. 100 for it. The reason is very simple.

If the buyer pays Rs. 100 and at the end of the year receives Rs. 10 as interest, then his investment has yielded interest of only 10%, whereas elsewhere he could have gained 20%. The buyer can at best offer Rs. 50 for the bond, so that when he receives the Rs. 10 interest, his investment has earned 20% (which is indeed the market rate of interest). Thus, because the market rate of interest has risen, the market value of the bond has fallen.

The converse is also true if the market rate of interest falls, the market value of a bond will rise. If, in an example, the rate of interest falls to 5%, the value of the bond will rise to Rs. 400. It is because the return from this bond at 5% interest will now be Rs. 20.

According to Keynes, the speculative demand for money will be determined by people’s expectations regarding the market rate of interest. If the rate of interest is very low and people expect it to rise (or the. value of bonds to fall), then they will consider it more judicious to hold money rather than bonds. If, on the other hand, the rate of interest is very high and people expect it to fall, then they will prefer to hold bonds instead of money.

ADVERTISEMENTS:

Thus, there is an inverse relation between the rate of interest and the demand for money. At high rates of interest people hold less money and vice versa. Another reason is that if the rate of interest is high, it is ‘more expensive’ to hold money, i.e., the interest which is foregone by not investing the money is at a high level.

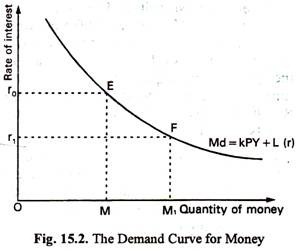

For these two reasons, the demand for idle money balances is inversely related to the rate of interest. Keynes assumed that the demand for money for the other two motives is not affected by changes in the rate of interest, i.e., is perfectly inelastic with regard to the rate of interest. Therefore, if all three elements in the demand for money are added together to derive the total demand curve for money, the result would be a curve of the type shown in Fig. 15.2. (A demand curve for money is also known as a ‘liquidity preference curve’.)

The curve shows that if the rate of interest falls, e.g., from O0 to Or1, the demand for money increases, from OM to OM1. According to Keynes, at some low rate of interest the demand for money becomes perfectly elastic because if the rate falls below this level, no one would be prepared to buy bonds.

Determination of the Rate of Interest:

ADVERTISEMENTS:

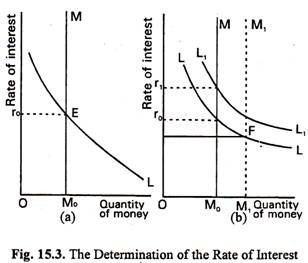

The rate of interest, which is the ‘price’ of money, is determined by demand and supply in a competitive situation. We have seen that the demand curve for money is downward sloping. We assume that the supply curve will be perfectly inelastic with regard to the rate of interest, i.e., that the supply is determined by the monetary authorities and does not vary with the rate of interest in the short run. Thus, in Fig. 15.3(a) the supply of money is represented by the perfectly inelastic supply curve, M.

The equilibrium rate of interest is Or0 because it is the only rate of interest at which the money market is in equilibrium, e.g., the demand for money is equal to its supply.

What is the logic of this equilibrium? If the rate of interest goes above the equilibrium level there will be excess supply of money or excess demand for bonds. The price of bonds will rise or the rate of interest will fall. On the other end, if the rate of interest goes below the equilibrium level, there will be excess demand for money, i.e., people will need more money to hold that is currently being supplied by the central bank. To meet this demand people will sell bonds. There will be excess supply of bonds. Bond price will fall or, what comes to the same thing, the rate of interest will rise.

Shifts of Supply and Demand Curves:

Both the demand and supply curves may shift to left or right if circumstances change. For instance, if incomes rise the demand for money will shift to the right, because people will need more money for transaction purposes. Consequently, the rate of interest will rise. This is indicated by the curve L1 which intersects the supply curve of money at point E so as to cause the rate of interest to rise to Or1.

By contrast, the supply curve will shift if the monetary authority (i.e., the central bank) increases or reduces the supply of money. The effect of an increase in the supply of money is illustrated in Fig. 15.3(b). If supply of money is increased from OM0 to OM1 the rate of interest will fall from Or0 to Or1. The reason is that at the old rate of interest the supply of money has become greater than demand and people use the surplus money to buy bonds. The increased demand for bonds causes the price (or the value) of bonds to rise. The rate of interest will, therefore, fall.

Criticisms of the Theory:

ADVERTISEMENTS:

Keynes’ liquidity preference theory has been severely criticised.

These are discussed here:

1. In the construction of the figure, speculative demand for money is included and the other two sources of demand are ignored. It implies that they are known and subtracted from total money supply. But they can be known only when income is in equilibrium, i.e., Y – C + I or S = I. Hence, liquidity preference theory requires as a pre-condition saving-investment equality, already postulated by classical scholars. Hence, the rate of interest is neither a purely monetary phenomenon nor a purely real phenomenon.

2. So far as the main content of the Keynesian interest theory is concerned, it is the determination of the rate of interest through equality between demand for, and supply of, money. But one of the components of total money demand—known as speculative demand—is assumed to depend on rate of interest. Hence, the logical circularity in the model can be mentioned as one of its principal sources of weakness.

3. Keynes ignored real factors like productivity of capital and thriftiness in the determination of interest rate.

4. As Jacob Viner has remarked: “Without saving there can be no liquidity to surrender.” According to Keynes, interest is a reward for parting with liquidity and in no way an inducement for saving, but it is ridiculous to think of surrendering liquidity if one has not already saved money.

Liquidity Trap:

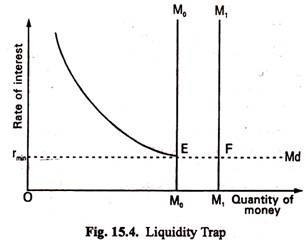

Liquidity trap refers to a situation where the rate of interest is so low that people prefer to hold money (liquidity preference) rather than invest it in bonds (to earn interest). Keynes pointed out that at low rates of interest the demand curve for money (or liquidity preference curve) becomes completely (infinitely) elastic. So the liquidity preference curve is not downward sloping throughout.

ADVERTISEMENTS:

This usually happens during depression. During depression any attempt by the central bank to reduce the rate of interest by increasing the stock of money will be futile. In such a situation, no change in money supply is sufficient to alter the rate of interest.

So it is not possible to stimulate more investment. In fact, any increase in the stock of money by the central bank will be held by the people in the form of liquid balance. This will prevent the rate of interest from falling further. See Fig. 15.4 where the completely elastic position (EFMd) of the liquidity preference curve is called liquidity trap.

The implication is that monetary policy loses its effectiveness if there is a liquidity trap in the demand curve of money. Keynes argued that the only way to stimulate investment in a depressed economy (which is experiencing liquidity trap) is to use a positive fiscal policy. Such a policy works through an increase in government expenditure or reduction in taxes in order to increase aggregate effective demand.

The reason is simple. People feel that the rate of interest has fallen enough. It cannot fall further. Thus, if it rises in near future the price of bonds (purchased now) will fall. So purchase of bonds is risky. Money-holding is not that costly because the rate of interest is low.

ADVERTISEMENTS:

Thus, people prefer to hold as much money as possible, with the expectation that the rate of interest will rise in future. As soon as it rises they will buy bonds. In such a situation any additional money supplied by the central bank will be absorbed by the people and this will prevent the rate of interest from falling further.

The Possibility of Zero Rate of Interest:

Interest is treated as a price paid by borrowers to lenders and will depend on the supply for and demand of loanable money for various purposes. Generally, a large supply of capital relating to the demand means low rates of interest and a large demand relative to supply means high interest rates.

According to some writers, the rate of interest would fall to zero in a static economy where the demand for loanable funds is nil. In a static economy, there is no fresh investment, the demand for loanable funds is nil and so the rate of interest would be zero.

From the point of view of the demand for loans, zero rate of interest means that the marginal net product of capital is nil. This means that we cannot increase society’s total product further by employing more capital. We have reached a state in which our productivity is maximum. It means that all our wants have been satisfied. So the demand for capital will be zero.

But, it is not likely that the demand for loan-capital will be ever zero. But, in reality, we cannot think of a state of society in which people will have no wants, and no desires. So long as they remain, there will always be endless possibilities for employing capital. The rate of interest, therefore, cannot be zero.

There are certain dynamic forces like inventions and discoveries, growth of population, etc. which keep always up the demand price of loan-capital.

ADVERTISEMENTS:

Similarly, from the supply side, a zero rate of interest means that people will go on lending without expecting any return in exchange. But the liquidity preference will not drop to zero for a number of reasons. As the rate of interest falls, more money will be absorbed by people to satisfy transactions demand for money.

Moreover, the zero interest rate means that the liquidity-preference also becomes zero; people lend money without any interest. But such a situation is most unlikely to appear in reality. There are always reasons why the liquidity-preference would never drop to zero.

As the holding of cash-money has the distinct advantages over the holding of other assets, people will always prefer cash money to other assets. It means that the liquidity- preference cannot drop down to zero, and from this it follows that the rate of interest will never fall to zero. All these set a limit much above zero to the practical decline in the rate of interest.

In the Keynesian theory it is also seen that the rate of interest cannot fall below a certain level where the demand for liquidity becomes infinitely elastic and that situation has already been described as the liquidity trap (Fig. 15.4), a term first used by D. Robertson.