The following points highlight the twelve main concepts for managerial decision making. Some of the concepts are: 1. Direct and Indirect Cost 2. Opportunity Vs. Outlay Cost 3. Relevant Costs and Irrelevant Costs 4. Past vs. Future Cost 5. Traceable (Separable) and Common Costs 6. Out of Pocket and Book Costs 7. Committed and Discretionary Costs 8. Marginal and Incremental or Differential Cost and Others.

Concept # 1. Direct and Indirect Cost:

In the commercial world, some costs are incurred that can be directly attributed to the production of one unit of a commodity. It is usually possible to determine the cost of raw materials, labour inputs and machine time involved with production of each unit.

On the contrary, the cost of fuel, office and administrative expenses, depreciation of plant, machinery and buildings and other items cannot be easily and accurately separated and attributed to individual units of output (except on an arbitrary basis).

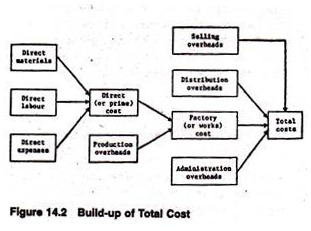

Cost and management accountants speak of the direct, or cost per unit, when they refer to separate costs of the first category. Likewise, they refer to indirect or overhead costs when they refer to the joint costs of the second category. The build-up of total cost showing how direct and indirect costs are related is illustrated in Fig. 14.2.

Direct and indirect costs do not necessarily coincide with the economist’s concepts of fixed and variable costs. The criterion used by the economist to draw a distinction between fixed and variable cost is whether or not the cost varies with the level of output. But the criterion used by the accountant is whether or not the cost is separable with respect to the production of individual units of output.

To establish the equivalence between economist’s cost concepts and accountant’s cost concept we must search out or identify that part of the indirect or overhead cost which varies with the level of output.

In cost accounting, overhead expenses are often divided into two components:

(a) Variable overhead and

ADVERTISEMENTS:

(b) Fixed overhead, in which case variable overhead expense per unit must be added to the direct cost per unit to arrive at the economist’s concept of average variable cost.

Concept # 2. Opportunity Vs. Outlay Cost:

We often draw a distinction between outlay cost and opportunity cost on the basis of the nature of sacrifice. In managerial decision-making, a cost is not really a cost unless it requires a sacrifice of alternatives, i.e., unless it is an opportunity cost. Therefore, it is the most important concept for managerial decision-making.

On the contrary, the concept of cost which normally enters into the accounts of a business is known as outlay cost. Outlay cost refers to the actual expenditure incurred on raw materials and other productive facilities. Such costs involve “financial expenditure at some time and hence are recorded in the book of accounts.”

On the contrary, opportunity costs “take the form of profits from alternative ventures that are foregone by using limited facilities for a particular purpose. Since they represent only sacrificed alternatives, they are never recorded as such in the financial accounts.”

ADVERTISEMENTS:

For most productive resources such as capital goods and machinery which have already been bought and are in the possession of the firm, the original price is not relevant for decision-making.

Their value now depends entirely on the possibilities that are open to the firm at present. The use of an idle machine that has no alternative use is cost-free for a particular purpose, regardless of the amount of depreciation being charged on the machine. Likewise, if the output of a mini steel plant or glass factory cannot be sold profitably, there is no opportunity cost associated with letting out the plant.

Only if the decision maker can find a genuine profitable use for the space that had been lying idle, one can assign a so-called user cost to the previously idle work space.

In the use of a machine or an equipment that has been completely written off the book, the accounts involve a cost if its use for the purpose under consideration, requires the giving up of alternative opportunities. In short, the cost of using a resource for one purpose is its value in the best alternative use which has to be given up. This is the essence of the opportunity cost principle.

Opportunity costs are implicit in nature. If a firm cannot use the raw material it has already purchased, and no one else can be found who wants it, then the material is valueless irrespective of what was originally paid for it. If we use it for one purpose it cannot obviously be used for another.

Consequently opportunity costs are incurred by using resources to accomplish some objective as opposed to using the same resources to accomplish some other goal. In reality, we hardly come across any resource which has no alternative use.

Concept # 3. Relevant Costs and Irrelevant Costs:

Costs that will be incurred as a result of a decision are known as relevant costs. These are relevant for future decision-making. On the contrary, costs that have already been incurred irrespective of what is being done by the firm at present are irrelevant costs. They have no relevance as far as current decisions are concerned.

Concept # 4. Past vs. Future Cost:

Joel Dean has drawn a distinction between past and future costs. He has highlighted the point that “Most of the important managerial uses to which cost information is put actually require forecasts of future costs, rather than ‘actual costs’, i.e., unadjusted records of past costs.” Since managerial decisions are always forward-looking, cost forecasting is essential.

Cost forecasting is essential for expenditure control, projection of future income statements, capital investment decisions, pricing, and decision on developing new products and dropping old products.

Concept # 5. Traceable (Separable) and Common Costs:

ADVERTISEMENTS:

Business managers often find it necessary to draw a distinction between common and traceable (separable) costs. Most modern business firms produce more than one product and are thus faced with the problem of common costs. In such cases, it is difficult to attribute costs to particular products inasmuch as they result from the mix of products rather than one product taken at a time.

However, by applying incremental reasoning, it is possible to resolve much of the confusion that arises when managers try to determine which costs are common and which are traceable to a particular product. It is quite easy to determine how much a change in output of a single product, brings about a change in a particular kind of cost. But it is quite difficult to determine a product’s fair share of that cost.

However, what is really relevant for managerial decision-making is the change in cost rather than its traceability. But it is necessary to take into consideration those situations in which an increase in the output of product A results in an increase (or decrease) in the marginal cost of product B.

Such problems are important in obtaining the product mix in those industries in which the same raw materials or processes result in a variety of end products.

Concept # 6. Out of Pocket and Book Costs:

ADVERTISEMENTS:

Out-of-pocket costs refer to cost that involve “current payments to outsiders as opposed to book costs, such as depreciation, that do not require current cash expenditures”. The payments for raw materials are an out-of-pocket cost. However, all out-of pocket costs are not variable, e.g., the night watchman’s salary.

Book costs can be “converted into out-of-pocket costs by selling assets and leasing them back from the buyer”. For example, you can sell your factory building but can continue to use it by paying rent to the new owner. The rental payment then replaces the depreciation charge and interest cost of owned capital.

In an expansion problem, book costs, such as depreciation, do not exist, since the new equipment has not been purchased. Often managers use the term ‘out-of-pocket costs’ to mean incremental costs. But the salary of a supervisor requires a cash outlay which may not be incremental for a given increase in output. Often the term ‘out-of-pocket’ is ambiguous on what is really intended.

Concept # 7. Committed and Discretionary Costs:

Businessmen and economists often speak of “completely fixed expense”. This expression is open to diverse interpretations.

ADVERTISEMENTS:

The following cost concepts are distinguished:

(a) Escapable Costs:

Cost which are fixed as long as operations are going on, but which are escapable if operations are shut down. An example will be the salaries of the supervisory staff.

(b) Stand-by Fixed Costs:

Costs which are to be incurred even if production is halted but which are escapable if the company is liquidated. These costs are inescapable in the short run but escapable in the long run. Wages of watchmen or the minimum heating expense required to prevent the freezing of pipes are obvious examples.

(c) Committed Costs:

ADVERTISEMENTS:

Costs which cannot be escaped even if the company is dissolved and the assets sold are known as unavoidable contractual costs. Such would be true of the depreciation on equipment which has no market value.

These costs are not economic costs in the true sense since the opportunity costs are nil. But they may appear in the accounts. These costs should be called ‘completely sunk costs’, since they are not escapable under any circumstances.

(d) Discretionary Costs:

They are costs which are not the result of output but which are at the discretion of management. Examples are advertising expense, research expense, and consultants’ fees. This category may sometimes include a substantial part of wages and salaries. These expenses go under the names of “programmed fixed costs” or “discretionary expenses”.

In retail markets, e.g., in grocery stores, costs can be broken down into three categories: fixed costs, discretionary fixed and variable costs. The discretionary fixed costs are those that remain fixed with respect to volume but subject to managerial decisions.

Services such as factory clearance and maintenance, garbage haulage, legal and accounting services could be curtailed at a zero level of output. The most important item in this category, labour cost, is clearly not a variable cost in grocery shops.

Concept # 8. Marginal and Incremental or Differential Cost:

ADVERTISEMENTS:

We have already introduced the concept of marginal cost. Marginal cost has been defined as the addition to total cost which results from the production of one extra unit. This conception is of limited value for decision-making, because an increment of one unit is often too small to have any operational significance.

It is easy to measure marginal cost when the firm or plant produces a single homogeneous product by the use of facilities which are devoted solely to that product. But in practice it is difficult to measure marginal cost accurately because most products require the use of both specialist and multi-purpose machinery and share the use of the latter with other products.

The concept of incremental or avoidable (escapable) cost generalizes the concept of marginal cost. And, for most practical decision problems, the two terms incremental cost and differential cost are used synonymously. Underlying these two cost concepts is the notion of a change in the total costs resulting from the implementation of a decision.

The decision may involve change in production, marketing or any other business activity. For example, the decision to float a new share, install a data processing system or launch a new advertising campaign is not directly reflected by a change in production. Still there is a change in total cost.

So the change in total cost that results from a change in an activity is incremental cost. If, for example, a firm opens up a new channel of distribution, many elements of cost will remain unaffected.

But some additional costs have to be incurred, e.g., additional salesmen are to be employed, the information has to be brought to the notice of new customers through trade journals or newspapers and so forth. Some management has to compute the addition to costs which would result from the decision.

ADVERTISEMENTS:

This additional cost has to be compared with the additional revenue that is likely to accrue as a result of the decision. These costs are escapable if the decision frees the enterprise from raising funds that would have been required otherwise.

If, by reducing production by 10% a firm can save material cost by Rs. 2,000 and labour cost by Rs. 1,000, these costs are escapable. But since no permanent worker (like a line supervisor) can be laid off as a result of the decision, their salaries do not enter into the escapable-costs calculation.

There are certain practical limits to the extent to which the incremental cost analysis can be applied. Gorden Sillingham has suggested that minor variations in costs arising out of the decision may have to be ignored.

It is in this context that he developed the concept of attributable cost. This is defined as the cost per unit that could be avoided, on the average, if a product or function was totally discontinued without changing the supporting organisation structure.

As for the use of incremental cost concept in decision-making, it is now evident that the perspective differences among alternatives are the only relevant factors to be considered. In any business, all past receipts and expenditures as also many future ones are not at all affected by a particular choice.

Costs that are not affected as a result of the decision are called sunk (historical) costs and are irrelevant for decision-making. On the other hand, a cost is incremental if it results from a decision. For example, the decision maker must consider incremental interest if the decision requires additional capital expenditure on a project.

ADVERTISEMENTS:

However, incremental costs need not necessarily vary with output, product or absolute cash outlays. For example, suppose, after a major thunder shower, Indian Airlines management has to decide whether or not to put on an extra flight from Patna to Ranchi.

The relevant costs to be considered here are the extra fuel costs, wear and tear on tires, the out-of-pocket costs associated with ground crews in both locations, wages, salaries and expenses associated with the flight itself and airport tax (landing fees), if any. What has to be overlooked is the portion of depreciation that continues regardless of whether or not the extra flight is added.

In some situations, incremental costs and opportunity costs may be placed in the same category, i.e., “the incremental cost is the foregone opportunity of using limited resources in one activity as compared with another.”

By contrast, the cost of using an idle factory space is zero, because it has no alternative uses.

Concept # 9. Sunk and Escapable Cost:

We have already noted the distinction between sunk and escapable costs. However, whether certain costs are escapable or inescapable varies according to the decision. Some costs are escapable or avoidable. But some costs that cannot be escaped as a result of reduction in output can be escaped only by closing down a certain operation or a department.

A part of depreciation which varies with the use of a machine (the so-called user cost) can be avoided by reducing output. But depreciation is also a function of time and not just a function of use. Therefore, the part that continues regardless of output is escapable only if the machine or building is sold and if, of course, there is a ready market for the asset.

Concept # 10. Controllable and Uncontrollable Costs:

The controllability of a particular expenditure depends upon the level of management, i.e., it is related to a special center of managerial responsibility. Some costs are not, of course, controllable at the shop level because they depend on decisions at the top level. But, in the final analysis, all costs are controllable in the sense that, somewhere in the organisation chart, there must be someone who is responsible for them.

But all costs are not equally reducible. For example, the manager of a production department is unlikely to have any influence over wage rates which will be determined by collective bargaining. He may, of course, have some degree of control over the number of workers employed in his department or overtime worked.

Concept # 11. Shut-down and Start-up Costs:

T. J. Coyne, an expert on management finance, has distinguished between shut-down and start-up costs. He has pointed out that both implicit and explicit costs are incurred in the short-run when a firm decides to close down its operation. In the case of a car manufacturing company, the cost incurred in protecting the plant and equipment while it is temporarily idle must be calculated.

If the plant is supposed to reopen in near future, implicit and explicit short run start-up costs associated with the reopening need to be calculated in addition.

However, only the explicit portion of shut-down and start-up costs will be accounted for by the firm; the implicit portion often goes unreported. Business economists recognize such implicit shutdown and start-up costs when they analyse the financial impact on the firm in the short run, of the shut down and/or start-up decision.

Concept # 12. Replacement and Historical Cost:

Replacement costs and historical costs are two different methods of asset valuation and are often used to determine business income. As Dean puts it: “Historical cost valuation states cost of plant and materials, for example, at the price originally paid for them, whereas replacement cost valuation states the costs at prices that would have to be paid currently.”

Costs reported by traditional financial accounts are mostly based on historical (original outlay) valuation. But in a period of inflation (or deflation) projection of future costs on the basis of historical costs and valuation of assets on the basis of such costs is not quite relevant for various management decisions. Capital replacement decisions based on historical costs may involve the company in a loss.

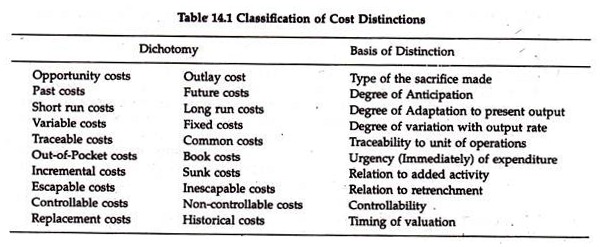

The set of distinctions among various cost concepts has been summarized by Joel Dean in the following table: