1. The leisure-income trade-off and the need for overtime rates higher than the normal wage rate:

Indifference-curves analysis may be used to explain why firms must pay higher rates for overtime work.

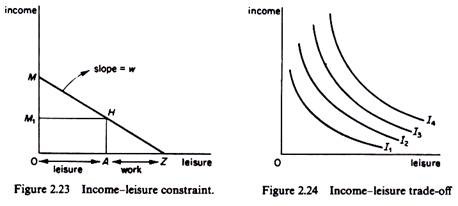

We first derive the income-leisure curve of an individual consumer. This curve shows different combinations of income, earned by working, and leisure time.

Assume that we measure money income on the vertical axis and leisure time on the horizontal axis. Assume further that the maximum time available for either leisure or work is 0Z hours a day.

ADVERTISEMENTS:

The individual can either use all the 0Z hours for leisure, in which case he earns zero income, or he can choose to work all the 0Z hours and earn a maximum money income 0M (given the current market wage rate w) or he can use part of the 0Z hours for leisure (e.g. 0A) and the remaining (AZ) hours for work, in which case he would earn 0M1 income.

The line MZ is the income-leisure curve, which shows how much time of his leisure an individual must give up if he wants to earn a certain income.

ADVERTISEMENTS:

The slope of the income-leisure line is equal to the market wage rate.

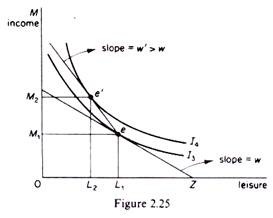

We may next construct the indifference map of the individual, which shows the ranking of his preferences as between income and leisure. Each indifference curve shows various combinations of income and leisure which yield the same level of satisfaction (utility) to the individual. The indifference curves have the usual properties they are convex to the origin, they do not intersect and they show a higher level of satisfaction the further away from the origin they are.

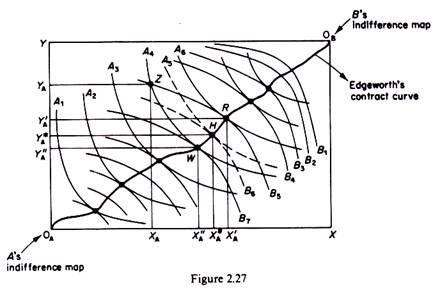

The individual’s equilibrium is determined by the point of tangency of his income- leisure line with the highest possible trade-off curve (point e in figure 2.25). Given the wage rate w, the individual maximizes his utility by working L1Z hours, earning income 0M1, and using the remaining time (0L1) for leisure.

If firms want more hours of work they will have to pay a higher hourly rate than the normal w in order to give an incentive to the individual to reduce his leisure time. An increase in the overtime rate is depicted by a leisure-income line which is steeper to the left of e (figure 2.25). With higher overtime payment the individual will be induced to give up some of his leisure time because in this way he will reach a higher indifference curve. The income-leisure line becomes kinked at e, and the new equilibrium of the individual is at e’ on indifference curve I4, showing that he will increase his working hour (by L1L2) and earn a higher income (0M2 > 0M1).

ADVERTISEMENTS:

2. Evaluation of alternative government policies using indifference-curves analysis:

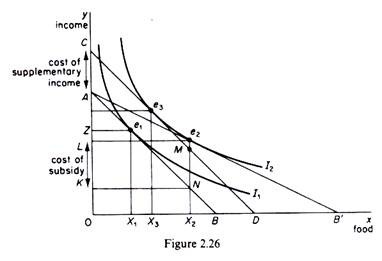

Indifference curves may be used to evaluate the effects of alternative government policies. For example, assume that the government considers either the adoption of a food subsidization policy for pensioners or granting a supplementary income to them. Which of these measures costs less to the government (and hence to the tax payer)? What are the effects of these policies on the demand patterns of a pensioner? Such questions may be answered by using indifference-curves analysis. We will illustrate the way in which the above information may be obtained, assuming for simplicity that there is a single pensioner and two commodities, x (food) and y (money income).

The effects of the food subsidy:

Assume that the government gives food coupons to the pensioner which allow him to buy food at half the market price. Following this measure the budget line of the pensioner shifts to AB’, which is tangent to I2 at point e2. At his new equilibrium position the pensioner buys 0X2 units of food, paying for this quantity AL of his income. If there were no food subsidy the pensioner would have to spend AK of his income to buy 0X2 units of food.

Since he pays only AL, the difference LK – (AK — AL) must be paid to the food producers by the government.

Thus, if the government adopts the food subsidy policy we have the following effects:

(a) The cost to the government (and to the taxpayer) is LK.

(b) The market price of food is not affected by this policy, so that other consumers continue to pay the original price,

ADVERTISEMENTS:

(c) The government is certain that the pensioners will consume more food.

This effect may be particularly desirable (as a subsidiary goal of the government) if there are surpluses of food. Actually it is often the case that food subsidies are designed in such a way as to benefit not only the consumers but also the producers of foodstuff, (d) the assistance to pensioners via the food subsidy imposes a certain pattern of consumption, a certain choice of spending their income.

The effects of a supplementary income policy:

Assume that the government considers granting to the pensioner a supplementary income which will enable him to reach the higher welfare level implied by indifference curve I2. To find the amount of such a supplementary income we simply draw a budget line (CD), parallel to the original budget line (AB) and tangent to I2 (at point e3). The pensioner will now buy 0X3 units of food. The cost to the government of the supplementary income policy is equal to CA, which (in our example) is smaller than the cost of the food subsidy policy. Furthermore the quantity of food in this case (0X3) is smaller than the quantity which would be bought under a food subsidy programme (0X2).

ADVERTISEMENTS:

Comparing the two alternative policies we observe that both policies achieve the government’s goal of enabling the pensioner to reach the higher welfare state implied by I2. But the food subsidy programme is more costly (in our example) than the supplementary income policy. In fact if the government were to give to the pensioner the cost of the subsidy in the form of supplementary income, the pensioner would attain a higher level of satisfaction (an indifference curve above I2). However, the consumption of food will be greater in the case of the food subsidy policy.

Which one of these alternative policies the government will adopt depends not only on the above considerations, but also on the other goals of the government and the indirect effects of each policy. For example, if there is a surplus food production, the government may adopt the more costly subsidization policy, which, apart from increasing the welfare of the consumer, also benefits the producers by reducing or even eliminating the surplus. Furthermore, supplementary incomes policies are in general more inflationary than price subsidies to specific individuals (especially if there is a surplus of the subsidized commodities). Increasing the incomes of some groups of ‘needy’ consumers may lead to increases of the market prices of commodities for all consumers, thus decreasing their welfare. The above discussion illustrates how indifference-curves analysis may give insight into, the implications of selective government measures, and thus help efficient policy formulation.

3. Indifference-curve analysis and the theory of exchange:

Indifference-curves analysis may be used to explain why exchange of commodities among individuals (or groups of individuals, countries, regions, and so on) takes place. We will show that, under certain conditions, exchange of commodities leads to an increase in the welfare of at least one individual without any reduction in the welfare of the other, so that the overall welfare which can be enjoyed from a given bundle of commodities is increased.

ADVERTISEMENTS:

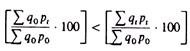

We will use the device of the Edge-worth box. We assume that there are only two individuals, A and B, and two commodities, x and y, whose quantities are given. These quantities are measured along the sides of the Edge-worth box. Any point of the Edge- worth box shows a certain distribution of the available quantities of x and y between individuals A and B.

The preferences of consumer A are represented by a set of indifference curves (denoted by A with an appropriate subscript) which are convex to the origin 0A. The preferences of consumer B are represented by the set of indifference curves (denoted by B with an appropriate subscript) which are convex to 0B. The indifference maps have the usual properties.

For example, the further down an indifference curve of B lies, the greater is the satisfaction. The two sets of indifference curves, being of opposite curvature, have points of tangency which form the so-called Edge-worth’s contract curve (0A0B in figure 2.27).

In other words the contract curve is the locus of points of tangency of the indifference curves of A and B, and therefore the locus of points at which the MRS of the two commodities is the same for both consumers

MRSAy,X = MRSBy, x

ADVERTISEMENTS:

Only points lying on the contract curve represent optimal distribution of the available quantities of x and y between the two consumers, in the sense that any divergence from this curve implies a lower level of satisfaction for at least one individual. For example, consider point Z off the contract curve. At this point consumer A owns 0XA of commodity x and 0YA of commodity y, with the remaining quantities (XAX and YAY) owned by consumer B.

With this distribution of the two commodities consumer A is on indifference curve A4 while consumer B is on indifference curve B5. We will show that point Z represents a suboptimal distribution of x and y, because if A and B exchange some of the quantities of the two commodities so as to move to any point on the section WR of the contract curve at least one (and probably both) of them will be better off (on a higher indifference curve) without the other being worse off.

If the consumers exchange x for y so that they arrive at the distribution denoted by R (consumer A giving away YAY’A of commodity y in exchange for XAX’A of commodity x), consumer A will reach a higher welfare situation (moving from indifference curve A4 to the higher one A6) while consumer B retains his initial level of satisfaction (both Z and R lying on the same indifference curve B5).

If the consumers reach, via exchanging commodity x for y, to the distribution denoted by W the opposite situation will obtain: consumer A will retain his initial level of satisfaction (since Z and W lie on the initial indifference curve A4) while consumer B will attain a higher indifference curve (B7).

If the consumers reach any other distribution between W and R, e.g. the one denoted by H, they will both be better off, reaching higher indifference curves (A5 and B6 respectively) as compared to their initial positions at Z.

If exchange takes place who will benefit more, A or B? The answer to this question cannot be given on purely economic criteria. The final distribution of x and y and the ‘gains’ from the exchange of these commodities will largely depend on the bargaining skills and power of the two individuals. Usually the consumers will reach a point between W and R, both gaining some welfare in the process.

ADVERTISEMENTS:

In summary the contract curve includes optimal allocation of the commodities, in the sense that if the individuals are at a point off this curve they will gain by moving to a point on it, since at least one (or both) of them will be better off without the other becoming worse off.

It is implicit in the above elementary analysis of exchange that the tastes of A and B do not change and that the quantities of the two commodities are given. If these assumptions hold, the result of the act of exchange may be different.

4. Indifference-curves analysis of the cost of living:

Indifference-curve analysis and the theory of revealed preference can be used to establish whether, over a period of time during which both money incomes and prices have been changing, the consumer is better or worse off. The assumption underlying the following discussion is that the consumer spends all his money income in all time periods, that is, he chooses a point on his budget line in any particular period.

In the initial (base) period the consumer’s income and expenditure is:

Y0 = ∑ q0p0

ADVERTISEMENTS:

And in the current period

Y1 = ∑q1p1

Assuming that both prices and money income changed between the base and the current periods, how can we decide whether the consumer is better off? To answer this question we require index numbers of income and prices. An index of income changes is given by the expression

IY = (Yt / Y0). 100

Where Y0 = money income in the base period

Yt = money income in the current period

ADVERTISEMENTS:

The index number of the income in the base period is 100. If in period t the index number is 125 we conclude that money income has increased by 25 per cent in period t as compared with the base period.

Changes in the price level are measured by two traditional price indexes, the Laspeyres price index, defined by

L = (∑q0pt /∑q0p0) . 100

and the Paasche index, defined by

P = (∑qtpt / ∑qtpo)

Where q0 = quantities of the commodities bought in the base period

p0 = prices of the commodities in the base period

qt — quantities of the commodities bought in period t

pt = prices of the commodities in period t

Given the above index numbers we will prove that:

(i) The consumer is better off in period t as compared with the base period if the index number of income is greater than the Laspeyres price index, that is, if

(Yt / Yo). 100 > L

(ii) The consumer is worse off in period t as compared with the base period if the index number of income is smaller than the Paasche price index, that is, if

(Yt / Yo). 100 > P

The use of the Laspeyres price index. Assume that the initial income and expenditure of the consumer is

Yo = ∑ qopo

In period t prices have changed to pt, and if we estimate the cost of the ‘basket q0‘ at the new prices we find

∑qopt

If ∑ qopt < Yt, the initial ‘basket q0‘ is available to the consumer in the current price (and income) situation. That is, with his current income (Yt) the consumer can still purchase the original basket of goods if he so wishes. If he actually makes this choice in period t then

∑qopo = ∑qopt = Yt

and the consumer retains the same level of satisfaction in period t as in the base period (he remains on the same indifference curve). However, if the consumer chooses in period t another basket of goods qt (while q0 continues to be available) then two situations may occur:

either ∑qopt < ∑qtpt …(2.2)

which implies that q0 is below the new budget line of the consumer, who, buying qt, is better off (because he can buy basket q, which was beyond his means in the base period)

or ∑qopt = ∑qtpt

which implies that both baskets are equally expensive (q0 and qt both lie on the new budget line), but the consumer reveals his preference for qt presumably because q, gives him more satisfaction (lies on a higher indifference curve).

Dividing equation (2.2) through by ∑ q0p0 (the initial income) and multiplying by 100 we obtain

The left-hand side of this inequality is the Laspeyres price index, while the right-hand side is the income index number ∑ qtpt, being the current income and ∑ q0p0 being the income of the base period). Thus we may write

L < [Yt / Yo. 100]

Which shows that the consumer is better off if the Laspeyres price index is smaller than the income index? This conclusion may be illustrated diagrammatically by using indifference curves.

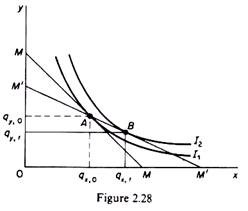

In figure 2.28 the initial budget line is MM, defined by the equation

Y0 = ∑q0p0 = (qx, 0) (Px.0) + (qy, 0) (py, 0)

The consumer is in equilibrium at point A, buying qx, 0 and qy, 0 of the two commodities.

The new budget line is M’M’ defined by the expression

Yt = ∑q1pt = (qx, t) (px, t) + (qy, t) (py, t)

The new budget line passes through the initial equilibrium point A, showing that ‘basket q0‘ is still available to the consumer at the new set of prices (pt). The consumer can, therefore, continue to purchase q0, thus remaining on the initial indifference curve I1. But he can reach a higher indifference curve (I2) by choosing basket qt shown by point B in figure 2.28.

This point was above the initial budget line, and hence beyond the reach of the consumer (given Y0 and p0). In other words the cost of bundle qt (= point B) estimated at the original prices (p0) was higher than the cost of bundle q0 (at p0). In the new price situation both bundles have the same cost since they lie on the new budget line (M’M’). Yet qt is chosen because it lies on a higher indifference curve: the consumer is better off with the new income (Yt) and the new set of prices (pt).

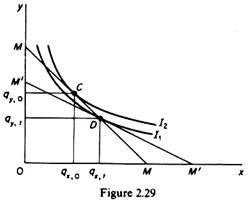

The use of the Paasche price index. Assume, as before, that in the base period the consumer has income Y0 and chooses basket q0, spending on it all his income ∑ q0p0 = Y0.

In the period t the consumer chooses a new basket qt, spending all his income ∑qtpt = Yt.

The cost of basket qt, estimated at the prices of the base period, is ∑qtp0.

If ∑q0p0 > ∑qtp0 (2-3)

then the basket chosen in period t (qt) was available in the base period, but was not chosen by the consumer, because presumably it was lying on a lower indifference curve than q0.

Given that in period t the consumer does actually choose qt spending all his income (∑qtpt) on it, it follows that basket q0 is now beyond his means (i.e. q0 is above the new budget line of the consumer). Hence the consumer is worse off in period t.

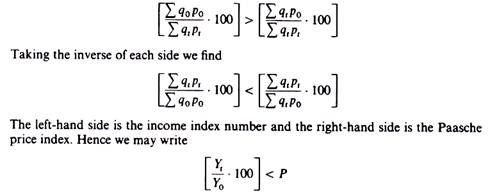

Dividing equation (2.3) through by ∑ qtpt and multiplying by 100 we obtain

that is, the consumer is worse off in period t as compared with the base period if the income index is smaller than the Paasche price index. We may show this result on a graph using indifference-curves analysis.

In figure 2.29 the equilibrium of the consumer in the base period is defined by C. Although basket D (including qx, t and qy,t) was on his original budget line, the consumer did not choose it, because it was lying on the lower indifference curve I1.

In period t the new budget line (M’M’) defined by the expression

Yt = ∑qtpt = (qx, t) (px, t) + (qy, t) (py, t)

lies below basket q0: the consumer cannot afford to buy the original bundle at the new prices (pt). Thus the consumer chooses basket qt, that is, he is worse off as compared to the base period. (If q0 was available in period t and the consumer chose qt, he would be inconsistent, since in the base period he had preferred q0 to qt).

It should be noted that comparisons of the above type are valid only if tastes and quality of the commodities have not changed in the two periods.