In simple words, ‘distribution implies to give each a share of his labour. Therefore, the theory of distribution deals with the pricing of factors of production.

For instance, the services of factors of production such as land, labour, capital and entrepreneur are used to produce certain goods and services.

As a result, what so ever is produced that is distributed among different factors of production in the shape of rent, wages, interest and profits respectively.

In this way, the theory of distribution in economics is concerned with the allocation of total production among various factors of production as a reward as rent, wages, interest and profits. Thus, the problem of distribution is just a problem of pricing of factors of production.

Aspects of Factor Prices:

Generally, there are two aspects of the price of each factor:

1. Price Aspect:

ADVERTISEMENTS:

Price aspect refers to the amount paid by a firm to a factor for its services in the process of production. In this regard, wages, salaries, interest etc. constitutes the price of the factors concerned.

2. Income Aspect:

Income aspect refers to the amount received by each factor of production for his contribution in the production process. The aggregate of income so received is called national income.

Types of Distribution:

The term distribution can be classified into two groups viz.;

1. Personal Distribution:

ADVERTISEMENTS:

It refers to the distribution of national product among various individuals of a country. It is related to the size and not source of the income of the individuals. According to D.W. Pearce, “Personal distribution refers to individual’s incomes regardless of the factors from which income is derived.”

Therefore, it is simply concerned with the problem of inequality in the distribution of income and wealth and the ways to reduce the inequalities. Moreover, Friedman calls personal distribution of income as distribution of national income among various individuals or persons in a society, not on the basis of their contribution to national income but on the basis of productive services owned and commanded by them.

A man may own inherited property, a large bank-deposit or may have shares of some successful companies. His income naturally will be more than a person who owns none or only a few of these assets. Thus, some people are rich, while others are poor. The theory of personal distribution studies how personal incomes of individuals are determined and how inequalities of incomes emerge.

2. Functional Distribution:

It is also called as income type distribution. It means distribution of national product among various factors of production according to the share of contribution to the output. In other words, it is concerned with the problem of pricing of the productive forces or determination of factor pricing. In the words of D.W. Pearce, “Functional distribution of income refers to the division of national product between the owners of different factors of production land-labour and capital.” Here, we must remember that in economics, distribution means functional distribution.

ADVERTISEMENTS:

However, theories relating to functional distribution are studied in two parts:

(1) Macro Theory of Distribution

(2) Micro Theory of Distribution

(1) Macro Theory of Distribution:

The macro theory of distribution deals with the determination of the aggregate rewards of various factors in national income. It explains the share of the total national income that each factor of production receives.

It enquires into the percentage of national income which is received by labour, capital, land, and organisation respectively. For instance, if we assume that India’s national income is Rs. 80,000 crore. Now, if out of national income labourers get Rs. 40,000 crore as their wages, capitalists Rs. 15,000 crore in terms of interest, entrepreneur Rs. 20,000 crore as profits and remaining Rs. 5000 crore gets landlords as rent then such a distribution will be termed as macro distribution.

(2) Micro Distribution:

The micro theory of distribution explains how the rates of reward for various factors of production are determined. It studies how the wage-rate or the rate of interest etc. is determined. In short, the micro-theory of distribution deals with the determination of relative prices of factors of production.

Problems of Functional Distribution:

As we know, there are four factors of production-land, labour, capital and organisation. These four factors of production join hands together and cooperate to produce a particular product which may be called National Dividend or National Product or National Income.

ADVERTISEMENTS:

The basic question is how this distribution should take place. In other words, how much should be the shares of land, labour, capital and organization. The problem before economists is to determine the size that is to be given to land, labour, capital and organisation from the National Income.

To be very simple, the problem of distribution is to determine the share of National Dividend that is to be given to land, labour, capital and organisation for their services in the process of production of National Dividend. Theories of distribution attempts to solve this problem.

If factors of production are not given a share equal to the amount of work performed by them, they will not cooperate in production and therefore, production will become difficult. The forces of demand and supply bring about an adjustment in such a way that every factor of production receives a share which is due to it.

Theory of Factor Pricing or Micro Theory of Distribution:

The term ‘distribution” can be explained in a number of ways. Commonly, it means to distribute or allocate but in economics, the other economic activities are production, consumption and exchange etc. In short, it relates to that economic activity which deals with the allocation of output or production among different factors of production. However, economists have defined the concept in the following ways.

ADVERTISEMENTS:

“The economics of distribution accounts for the sharing of wealth produced by a community among the factors which have been active in its production.” -Prof. Chapman

“Distribution is one of the main divisions of economics. It is concerned with the principles underlying the sharing out of the national income among the owners of the factors of production.” -Prof. J. L. Hanson

“Distribution is concerned with the problem of how the different factors of production-land, labour, capital and entrepreneurship are priced in the market.” -Prof. Paul A. Samuelson

Causes of Separate Study of Factor Pricing:

The theory of factor pricing deals with the determination of the prices of factors of production. Contrarily, theory of value deals with the determination of prices of goods. But the basic similarity between these theories is that both assume that price is determined by the interaction of demand and supply.

ADVERTISEMENTS:

Thus, it can be said that theory of factor pricing is actually a general price theory. But the question that arises, why factor pricing is not studied with product pricing. The answer is that there is difference in the nature of demand and supply of factors of production.

In the words of Briggs and Jorden, “Most modern economists agree that the prices paid for those factors are only particular aspects of the general law of pricing.” Therefore, factor pricing determination is separate from product pricing on account of the following factors:

(a) Difference in Demand:

The main differences between demand for factors and goods are as under:

(1) Demand for a Factor is Derived Demand:

The demand for a commodity is a direct demand while that for a factor of production is a derived demand. The demand for a factor of production arises from the demand for the commodity which the factor helps to produce. The demand for a factor is governed by its marginal productivity, while the demand for a commodity is governed by its marginal utility to the consumers. The demand for a factor being derived, the elasticity of demand for a factor depends upon, among other things, the elasticity of demand for the product.

(ii) Demand for a Factor is Joint Demand:

ADVERTISEMENTS:

The demand for various factors of production is necessarily a joint demand. No factor can be singly used; instead, two or more factors have to be combined in order to produce a commodity. This makes it difficult to determine the demand curve for one of the jointly demanded factors.

(b) Difference in Supply:

The main differences in the supply of factors and goods are as under:

(i) Cost of Production:

Supply of good is closely related to its cost of production. Cost of production of goods can be calculated while of factors it is not possible to calculate. Land has no cost of production for an economy. It is not possible to calculate the cost of production of labour

(ii) Relation between Price and Supply:

There exists wide difference in the relation between price and supply of factors as well as of goods. Generally, an increase in price of goods leads to an increase in supply. Therefore, supply curve is of upward sloping. On the other hand, there is no relation between supply and price of factors. An increase in rent will not cause any increase in its supply level.

Concepts of Productivity:

Marginal Physical Productivity:

Marginal Physical Productivity (MPP) refers to the difference made to total product by employing one extra unit of factor of production.

ADVERTISEMENTS:

“Marginal physical productivity may be defined as the addition to the total production resulting from employing one more unit of a factor of production, all other things being constant.” In the words of Mrs. Joan Robinson, “The marginal physical productivity of labour is the increment of output caused by employing an additional unit of labour with a fixed expenditure on other factors.” Ulmer

In mathematical terminology, marginal physical productivity is the difference between the total physical productivity of n units and total physical productivity of (n – 1) units.

This can be expressed as:

MPPn = TPPn – TPPn-1

MPPn = MPP of nth unit of labour.

ADVERTISEMENTS:

TPPn = Total physical productivity of nunits of labour.

TPPn-1 = Total physical productivity of n – 1 units.

Marginal Revenue Productivity:

Marginal revenue productivity is related to change in total revenue. In the words of Ulmer, “Marginal revenue productivity may be defined as the addition to total revenue resulting from the employment of one more unit of a factor of production.” Marginal revenue productivity is calculated by multiplying the marginal physical productivity with marginal revenue.

Thus,

MRP = MPP X MR

Value of Marginal Productivity:

ADVERTISEMENTS:

In order to calculate the value of marginal productivity, we have to multiply the MPP with average revenue. To Ferguson, “The value of marginal product of a variable factor is equal to its marginal physical product multiplied by the market price of a commodity in question.”

Therefore:

VMP = MPP X AR

Table Representation:

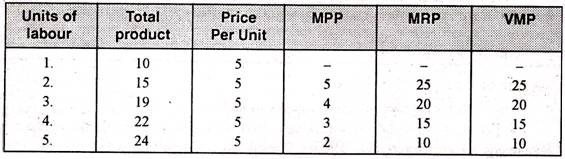

Different types of marginal productivities can be illustrated with the help of the following table 1:

Table 1 show that when the entrepreneur employs one unit of labour, total product is 10 units. But as he employs two labourers, total product goes up to 15 units; the marginal productivity of second labour comes out to be 5 units.

As the number of labourers increases their marginal physical productivity goes on diminishing. Under the conditions of perfect competition, AR = MR, so marginal revenue and value of marginal productivity will also be equal to each other.

Theories of Distribution:

There are two main theories of Distribution viz.:

A. Marginal Productivity Theory of Distribution.

B. Modern Theory of Distribution.