The factor price equalisation theorem suggests a even if the mobility of factors is limited by national frontiers, free trade in commodities helps to even out disparities in demand relative to supply of factors, and to diminish the discrepancy between factor returns among countries.

Two or more countries sharing the same technology will find that free trade brings factor returns to absolute equality even if their endowments are sufficiently similar and they produce in common a sufficient number of commodities (at least equal to the number of distinct productive factors).

As Caves Frankel and Jones put it:

“If countries share a common technology, free trade n commodities’ serves to equalize factor returns despite our assumption that factor movements are purely national and no international factor mobility is allowed.”

The Effect of International Trade on Factor Prices:

ADVERTISEMENTS:

Let us illustrate the FPET by assuming that there are two countries’ viz America (which is capital-abundant) and Britain (which is labour-abundant). Steel is the capital-intensive product and doth is the labour-intensive in nature.

Both countries produce two commodities, viz, steel and cloth In other words, specialisation is not complete in any country. Paul Samuelson has proved conclusively that even in the absence of factor mobility between countries free commodity trade leads to the equalisation of real factor rewards between two countries.

With free commodity trade, workers can earn the same real wage and capital the same real rental in both America and Britain. This is the effect of free trade in commodities on factor prices

Indirect Exchange of Factors:

In essence the HOT model refers to an indirect exchange of factors between countries. By exporting labour-intensive commodity (steel), the labour-abundant country (Britain) indirectly exports a certain amount of labour in exchange for a certain amount of capital. And the capital- abundant country does the opposite.

ADVERTISEMENTS:

This indirect exchange of labour raises the real wage rate in Britain and lowers the rate in America. It also lowers the real rental rate in Britain and raises it in America. Thus the HOT implies that factors do indeed migrate between countries not directly, but through the exports and imports of commodities.

Factor Prices and Commodity Prices:

As labour becomes relatively cheap (i.e., as the wage-rental ratio falls), the labour-intensive commodity (cloth) becomes cheaper relative to the capital-intensive commodity (steel).

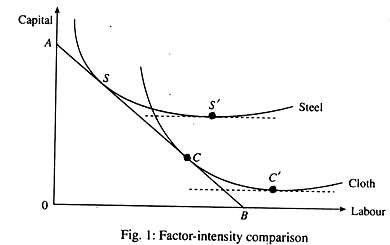

Figure 1 shows the unit isoquants for cloth and steel. At the initial factor prices, shown by the isocost line AB, the steel industry uses factor combination S, and the cloth industry C per unit of output. When the wage rate falls the isocost lines become flatter, shown by the dotted lines through S’ and C’. At the new wage-rental ratio, the steel industry will choose S’ and the cloth industry C’.

Since C’ lies on a lower isocost line than S’, at the lower wage-rental ratio, cloth becomes relatively cheaper than steel. This means that as the wage rate falls, the relative price of cloth also falls as long as cloth is labour-intensive relative to steel.

ADVERTISEMENTS:

Proof of FPET:

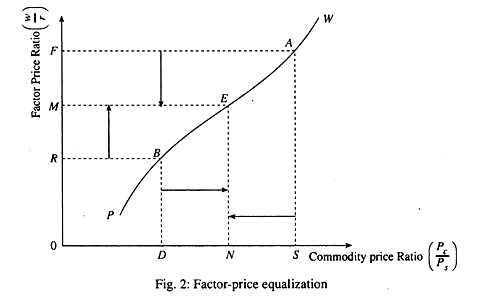

In Figure 2, the upward sloping curve PW shows the basic relationship between factor prices and commodity prices. As the wage-rental ratio falls from, say OF two OM, the relative price of cloth (the labour-intensive commodity) falls from OS to ON. Under autarky, America operates at A and Britain at B. With free trade, America exports steel and Britain cloth.

At the equilibrium relative price of cloth, ON, the same wage-rental ratio prevails in both countries since the marginal physical products of labour and capital are equalized between countries through forces of competition which lead to equalization of commodity prices.

Movement of Commodities as a Substitute of Factor Movement:

Thus, equalisation of commodity prices between two countries leads to equalisation of factor prices since movement of commodities under free trade acts as a substitute for the movement of factors of production. Thus, even in the absence of factor mobility, factor prices tend towards equalisation.

Incomplete Specialisation of FPE:

The equalisation of commodity prices (brought about by free commodity trade) implies that for any commodity price ratio a country produces both steel and cloth; the wage-rental ratio will also be the same for both countries. The reason is that the real factor prices are given by their respective marginal products of the two factors.

Since the production function in each country shows CRS, these marginal productivities depend only on the proportion in which labour and capital are used in the production of both the commodities—not on the absolute amount of labour and capital employed in each country.

Furthermore, in each industry capital-labour ratio is perfectly determined where the wage- rental ratio is given. Since both countries have identical production functions (by assumption), the equalization of the wage-rental ratio between America and Britain necessarily equates America’s marginal physical product of labour and capital to the corresponding marginal products of Britain.

ADVERTISEMENTS:

The logic of the FPET for the simple 2 x 2 case can be stated briefly. In a competitive equilibrium, unit cost equals price if the commodity is produced. Thus let A represent the matrix of input-output coefficients, aij, w the vector (pair) of factor prices and p the vector (pair) of commodity prices.

Technique need not be constant: in general they depend upon prevailing factor prices so that A = A (w). Therefore the competitive profit conditions if both goods are actually produced dictate that

A (w). w -p … (1)

Assuming no factor-intensive reversal, A (w) is non-singular. Therefore, if countries share the same technology, and face the same pair of free trade commodity prices, they must face exactly the same set of actor prices if each country produces both the goods, i.e., if specialisation is incomplete. The crucial issue in the factor price equalisation argument is the unique dependence of factor price vector w and commodity price vector p.

ADVERTISEMENTS:

In the 2 x 2 case, uniqueness is a simple question. It depends on factor intensities differing between sectors and not reversing. But this is not the only issue.

The question of uniqueness involves properties of technology alone, whereas under appropriate circumstances, two countries engaged in free trade will have factor prices equalised only if factor endowments are relatively similar. For if factor endowments are too dissimilar, it will be impossible for both countries to produce both commodities, in which case, the equality in (1) cannot universally hold.

The Cone of Diversification:

These ideas can be made more precise by considering a concept, called by John Chipman the cone of diversification. For any factor price vector w, there is determined a pair of techniques (labour/capital ratios) for the two commodities. Both factors can be fully employed only if the country’s endowment vector is contained within the cone spanned by these techniques.

Suppose two countries face a common free trade commodity price vector, p , and that the commonly shared technology associates a unique factor price w corresponding to this p. Then if the endowment vectors of both countries lie within the cone of diversification then, their factor prices must be equalized. Thus incomplete specialisation is a necessary condition for the FPET to hold. Two other conditions for it to hold are (1) identical production function and (2) CRS.

Significance of the Theorem:

ADVERTISEMENTS:

The equalisation of real factor rewards between countries is an important Pareto-optimal condition for the efficient allocation of resources worldwide. In a like manner, efficient resource allocation within a closed economy requires that identical units of the same homogeneous factors earn the same returns, efficient resource allocation in the world requires complete factor price equalisation.

Limitations of Sameulson’s Approach:

According to caves, Frankel and Jones, the EPET may not always hold even if countries do indeed share the same technology. The FPET presumes that factor endowment proportion do not differ much between countries, i.e., all countries have more or less similar endowments.

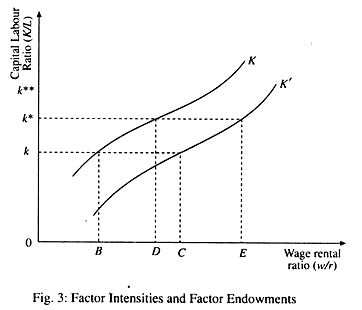

As Fig 3 illustrates, v, k and k* are the ratios in two countries, their factor prices cannot be equalized with trade. If the capital labour endowment ratios in Britain is k, the wage/rental ratio must lie in the range DC.

If the capital—abundant country has the endowment ratio k* there is an overlap of possible wage/rental ratios in the two countries, over the range DC. Free trade may equalize factor prices. If the US endowment ratio is higher (***), the relative wage rate in the USA will be higher than in Britain.

Conclusion:

ADVERTISEMENTS:

With free trade, at least one of the countries must be completely specialized, and the trade pattern must correspond to the H-O dictum that relatively capital-abundant countries must export capital-intensive goods.

In short, two countries that share the common technology but differ in their endowments of the basic factors of production may nevertheless find that free trade in commodities forces wage rates and rental rates in two countries into absolute equality.