Let us make an in-depth study of the trends in world trade and problems of developing countries.

Subject-Matter:

International trade and international investment have grown rapidly since the beginning of Industrial Revolution (1740).

For example, exports as a percentage of total national output grew from just 1% of the total value of world output in 1820 to about 14.1% in 2002. The process that we often refer to as globalisation in fact appears to be related to the economic growth that nations have enjoyed over the same period.

The increasingly close relationship between economies, or globalisation, involves more than just the growth of international trade in goods and services. The flows of capital and people across national borders have also been growing rapidly in recent years.

ADVERTISEMENTS:

Several recent economic crisis in developing countries such as the Mexican crisis of 1994 and the Thai currency crisis of 1997 have been linked to international capital mobility. This very fact suggests that capital flows can, under certain circumstances, slow economic growth. In fact, international lending, investing and aid are to all linked to economic growth in more ways than one.

There has occurred a rapid growth of world trade in the past two centuries (since the time of Britain’s industrial revolution). However, trade patterns today are quite different from those of the 19th century. Production at the centre of the world economy tends to be resource-saving instead of resource-using, and synthetics have replaced many raw materials. Furthermore, the trade policies of today’s industrialised countries are less liberal than those of the 19th century, which had no multi-fibre agreement (MFA) or common agricultural policy (CAP) of EU and no counter- veiling duties on Brazilian steel.

After World War I, tariffs rose sharply in both the USA and in Europe. In addition, many countries started to use quotas and other controls to protect their economies against the spread of the depression. Trade liberalisation began in 1947 with the signing of the General Agreement on Tariffs and Trade and first rounds of GATT negotiations.

During the 1950s, protectionist pressures in the USA slowed down trade liberalisation, but it regained momentum with the formation of the EEC, and the Kennedy Round of tariff cuts. In the 1970s, trade liberalisation took a new track. In the Tokyo Round, governments attempted to reduce non-tariff barriers, along with tariffs, and agreed on codes of conduct dealing with government purchases and with subsidies and dumping.

ADVERTISEMENTS:

But protectionist pressures built up strongly in the 1970s and 1980s, when economic growth slowed down and unemployment rose especially in Europe. The new protectionism also testifies to the success of previous trade liberalisation. Economies have become more open and more sensitive to global competition. Old industries such as textiles, steel and automobiles have been exposed to intense competition from new producers and new industries.

Growing protectionist pressures have also led to the more frequent use of antidumping and counter-veiling duties and to the introduction of market-operating measures in place of more traditional GATT procedures for settling trade disputes.

In short two distinct trends have emerged in the post Second World War period, viz.:

(1) the growing use of non-tariff barriers to protect domestic industries; and

ADVERTISEMENTS:

(2) the frequency with which dumping by foreign firms and subsidies by foreign governments have been used to justify protectionism.

In general, developed nations export mainly primary products, viz., food and raw materials in exchange for manufactured goods from developed countries. Until the 1980s, it was widely believed that international trade and the functioning of the present international economic system hindered development through declining terms of trade in the long run and widely fluctuating export earnings for developing countries.

This is why development economists advocated industrialisation through import substitution (i.e., the domestic production of manufactured goods previously imported). They did not place much reliance on international trade for promoting growth in developing countries.

They also advocated reforms of the present international economic system to make it more responsive to the special needs of developing countries. But most economists today believe that international trade, based on comparative advantage, can contribute significantly to the process of development of LDCs.

Developing countries are generally more dependent on trade than are developed countries. While large countries are understandably less dependent on trade than are small countries, at any given size, developing countries tend to devote a larger share of their output as merchandise exports than do developed countries.

Large countries like Brazil and India, which have had unusually closed economies, tend to be less dependent on foreign trade in terms of national income than relatively small countries like those in tropical Africa and East Asia. On the other hand, LDCs like India, Nepal, Bangladesh, etc. are more dependent on foreign trade in terms of its share in national income than the very highly developed countries are.

The greater share of developing country exports in GDP is probably due in part to the much higher relative prices of non-traded services, in developed than in developing countries. Moreover, the exports of LDCs are much less diversified than those of the developed countries.

Trade Related Problems Faced by Developing Countries:

1. Deterioration of the Terms of Trade:

According to some economists such as Prebisch, Singer and Myrdal, the commodity terms of trade (which is the ratio of the price index of exports to the price index of imports) -tend to deteriorate over time.

There are two main reasons for this:

ADVERTISEMENTS:

(i) Productivity increase:

Most or all of the productivity increases that take place in developed nations are passed on to their workers in the form of high wages and income. But productivity increases in developing countries lead to fall in commodity prices.

(ii) Income elasticity of demand:

The demand for the manufactured exports of developed nations tends to grow much faster than the latter’s demand for the agricultural exports of developing countries. This is due to much higher income elasticity of demand for manufactured goods than for agricultural commodities. For these reasons, self-sufficiency (no trade) is at times better than trade. As J. N. Bhagwati has argued, the deterioration in the terms of trade of developing nations could be so great as to make them worse-off with trade than without it. This is known as immeserising growth.

2. Export Instability and Economic Development:

ADVERTISEMENTS:

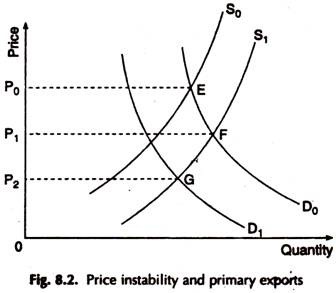

McBean has pointed out, apart from deteriorating long-run or secular terms of trade, developing countries may face large short-term fluctuations in their export prices and foreign exchange receipts that could seriously hamper their development. This point is illustrated in Fig. 8.2. D0 and S0 refer, respectively, to the demand and supply curves of developing countries.

With D0 and S0, the equilibrium price of primary exports of developing countries is P0. If D shifts to D1 or S to S1, the equilibrium price falls sharply to P1. If both D and S shift to D1 and S1 the equilibrium price falls even more to P2. If D1 and S1 again shift back to their original positions, i.e., D0 and S0, the equilibrium price moves back upto P0.

Thus, price inelastic and unstable D and S curves may lead to sharp price fluctuations. Here the range of price fluctuations is fairly wide P0-P2. Thus inelastic (i.e., steeply inclined) and unstable (i.e., shifting) demand and supply curves for the primary exports of developing countries can lead to large fluctuations in the prices of the exportable products of developing countries.

ADVERTISEMENTS:

The demand for primary products in world markets is both price inelastic and shifting. It is price inelastic because most households in developed countries spend only a small proportion of their income on such commodities as coffee, tea, sugar and cocoa. Consequently when the prices of these items change, households do not increase their purchases of these items much.

As a result the demand for such items becomes price-inelastic. On the other hand, the demand for various minerals is price inelastic because substitutes are not readily available. At the same time, the demand for the primary products of developing countries is unstable because of trade cycles in advanced countries.

The supply of most primary exports developing countries is price inelastic because of long gestations period in case of tree crops, especially plantations. Rubber trees require 10-15 years to grow. Moreover we find internal rigidities and inflexibilities in resource use in most developing nations. Supplies are unstable and shifting because of weather conditions, pests and so on.

Due to wide fluctuates in export prices, the export earnings of developing countries also vary significantly from year to year. This in its turn leads to fluctuations in national income, consumption, savings and investment. This type of economic fluctuations or business cycle movements render development planning (which depends on imported machinery, funds, raw materials) much more difficult.

International Commodity Agreements:

Some developing countries, especially in Africa, have attempted to stabilise export prices for individual products by purely domestic schemes such as the marketing board set up after World War II. These operated by purchasing the output of domestic producers at the stable prices set by the board, which would then export the commodities at fluctuating world prices. In years of bum-pest crops, domestic prices would be set below world prices so that the board could accumulate funds, which it would then disburse in bad years, by paying domestic producers higher than world prices.

ADVERTISEMENTS:

However, international commodity agreements offered most developing countries a strong chance of increasing their export prices and earnings. Such agreements are of three types: buffer stocks, export controls, and purchase contracts.

Buffer stocks involve the- purchase of the commodity (to be added to the stock) when the commodity price falls below the agreed minimum price, and sale of the commodity. Out of the stock its open market price rises above the established maximum price.

Export controls seek to regulate the quantity of a commodity exported by each nation in order to stabilise, commodity prices. This method completely avoids the cost of maintaining stocks.

Purchase contracts are long-term multilateral agreements that fix a minimum price at which importing nations agree to purchase a specified quantity of the commodity and a maximum price at which exporting countries agree to sell certain fixed amounts of the commodity. Purchase contracts thus avoid the disadvantages of buffer stocks and export controls but result in a two- price system for the commodity.