The below mentioned article provides a summary of Keynes’ money wage rigidity model of involuntary unemployment.

Introduction:

According to Keynes, due to money wage rigidity, that is, downward inflexibility of money wages, results in involuntary unemployment of labour.

The workers are rendered unemployed because at a given wage rate supply of labour exceeds demand for labour. Keynes believed that money wage would not change sufficiently in the short run to keep the economy at full employment.

Classical economists believed that money wage rate is perfectly flexible and adjusts to bring demand for and supply of labour in equilibrium and keep the economy at full employment level. To understand money wage rigidity which results in unemployment we have to examine why labour market does not clear through reduction in money wages, Keynes gave three reasons for the stickiness of money wage rate. It may be noted that stickiness or rigidity of money wage implies that money wage rate will not quickly change, especially in the downward direction to keep equilibrium at full employment level.

Causes of Money Wage Rigidity:

1. Money Illusion:

The first reason why firms fail to cut wages despite an excess supply of labour is that workers will resist any move for cut in money wages though they might accept fall in real wages brought about by rise in prices of commodities. Keynes attributed this to money illusion on the part of the workers.

ADVERTISEMENTS:

By money illusion it is meant that workers fail to realize that value of money, that is, its purchasing power in terms of commodities, changes when prices rise. They regard money such as a rupee as something which has a stable value or purchasing power, that a rupee is a rupee and a dollar is a dollar with fixed real purchasing power.

Therefore, while they would strongly oppose and resist any cut in money wages, they would not resist much if their real wages are reduced through rise in prices of commodities with money wages remaining constant. Thus Keynes wrote, “Whilst workers will usually resist a reduction of money wages, it is not their practice to withdraw their labour whenever there is a rise in the price of wage goods”.

There are two reasons for existence of money illusion:

ADVERTISEMENTS:

(i) First reason for the existence of money illusion is that workers of a firm or industry think that though rise in prices reduce their real wages, but that this rise in prices equally affects workers in other industries so that their relative wages as compared to those employed in other industries remain the same.

Therefore, workers who are more concerned with their relative position with other workers will strongly resist the cut in their money wages, while they will not oppose so strongly their cut in real wages through rise in the general price level.

(ii) The second reason for strong resistance to cut in money wages is that the workers blame their own employers for this, whereas they think that a cut in real wages through rise in prices in general is the outcome of the working of general economic forces over which strikes in an industry would have little effect. However, it does not necessarily mean that trade unions remain silent spectators if they feel that changes in Government policy adversely affect their economic interests.

From the above two reasons given for money illusion it follows that if additional employment can be created by lowering real wages, it is more practical to do so through bringing about rise in general price level rather than by cutting money wages.

2. Wage Fixation through Contracts:

ADVERTISEMENTS:

In most of the free market economies such as those of USA and Great Britain, wages are fixed by the firms through contracts made with the workers for a year or two. There is little possibility of changing money wages fixed through contracts when the situation of either surplus labour or shortage emerges.

For workers organised into trade unions wages are even rigid. Through collective bargaining by trade unions with the employers wage scales are fixed for 3 to 4 years by contract. Money wages cannot be changed when either surplus or shortage of labour emerges during the period of the contract.

Trade unions of workers never accept wage cuts even if some of union workers remain unemployed. Thus the sticky or rigid money wages lead to the existence of involuntary unemployment. This means that labour market does not clear in the short run.

3. Minimum Wage Laws:

Another reason for money wage rigidity or, what is also called money wage stickiness, is the intervention by the Government in fixing minimum wages below which employers are not permitted to pay wages to the workers.

4. Efficiency Wages:

Another factor which accounts for money wage rigidity is that employers themselves are not interested in lowering wages as high wages make workers more efficient and productive. The adverse effect of lower wages on workers’ efficiency may explain the unwillingness on the part of employers to cut money wages despite the excess supply of or unemployment of workers at higher money wages.

The practical difficulties pointed out by Keynes and his followers which are faced by firms in reducing wages and which therefore explain money wage rigidity or stickiness. The sticky or rigid money wages above the equilibrium level cause unemployment of labour.

Price Flexibility and Money Wage Rigidity: Keynes’ View of Involuntary Unemployment:

In Keynes’ contractual view of labour market, it is assumed that whereas prices are free to vary, the money wage is fixed. It is important to note that Keynesians do not believe that money wage rate is completely fixed or sticky. What they actually mean by sticky wages is that money wages do not fall quickly to bring demand for and supply of labour in equilibrium at full employment.

In their view money wages are very slow to adjust sufficiently to ensure full employment of labour when there is a decline in aggregate demand resulting in lowering of prices of products. As a consequence, involuntary unemployment comes into existence. It may be further noted that Keynes was particularly concerned with downward rigidity of money wages at which the demand for labour exceeds the supply of labour and consequently unemployment or excess supply of labour emerges.

It is important to note that Keynes accepted the classical theory of labour demand according to which firms demand labour up to the point at which real wage rate (that is, money wage rate divided by the price level or, W/P) is equal to the marginal product of labour.

ADVERTISEMENTS:

At a higher real wage rate, less amount of labour will be demanded and, at a lower real wage rate, more labour will be demanded or employed. In other words, demand curve of labour is downward sloping. Keynes’ theory of involuntary unemployment based on price flexibility and money wage rigidity is depicted in Figure 12.2.

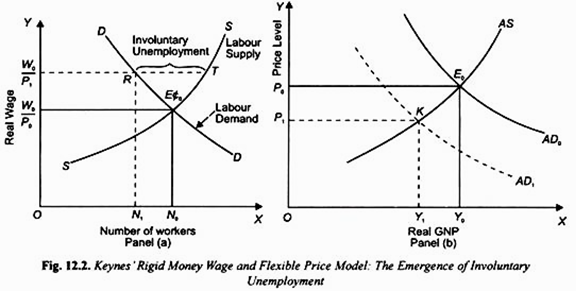

In panel (b) of Figure. 12.2 short-run aggregate supply curve AS and aggregate demand curve AD0have been drawn and through their interaction determine price level P0 and the level of real GNP equal to Y0.* It is important to note that short-run aggregate supply curve AS has been drawn with a given fixed money wage rate, say W0.

In panel (a) of Figure 12.2 the level of labour employment N0 shows the number of jobs when the economy is producing Y0 level of national output in panel (b) corresponding to the equilibrium between aggregate supply AS and aggregate demand AD0 at price level P0, with a fixed money wage and the level of GNP equal to Y0.

ADVERTISEMENTS:

The labour market must be in equilibrium at point E0 or at real wage rate W0/P0 at which N0 workers are demanded and employed. All those who are willing to get jobs at the real wage rate W0/P0 are in fact demanded and employed. Thus, equilibrium at E0 or at level of employment N0 represents full-employment equilibrium.

Now consider again panel (b) of Figure 12.2. Suppose due to fall in marginal efficiency of capital there is reduction in investment demand which along with its multiplier effect causes a leftward shift in the aggregate demand curve AD. Since Keynes believed that with a fixed money wage rate aggregate Supply curve AS is given and remains unchanged, it will be seen from panel (b) of Figure 12.2 that new aggregate demand curve AD1 and the fixed aggregate supply curve AS intersect at point K determining new equilibrium lower price P1 and smaller real GNP equal to Y1.

Keynes asserted that the economy would remain stuck at point K with less than full-employment level of output Y1 and lower price level P1. Now, a glance at panel (a) of Figure 12.2 shows that with fixed money image W0 and lower price level P1 (P1 < P0), the real wage rate rises to W0/P1. It will be seen from panel (a) of Figure 12.2 that at this higher real wage rate W0/P1 the smaller amount of labour N1 will be demanded and employed by all firms in the economy.

However, at this higher wage rate W0/P1 (with money wage rate fixed at W0), RT number of workers are rendered unemployed. It is in this way that Keynes explained that with money wage rate remaining fixed at the level W0 and with flexible prices, the fall in aggregate demand results in persistent involuntary unemployment.

ADVERTISEMENTS:

Thus, by explaining the emergence of persistent involuntary unemployment Keynes made a fundamental departure from the classical view of a free market economy which denied the existence of involuntary unemployment except for a short time.