Read this article to learn about Keynes effect of reducing the wage bill of employees and its limitations.

Keynes Effect:

It is maintained that a general wage cut will have the effect of reducing the wage bill, thereby leading to some reduction in prices and money incomes also. It will decrease the demand of cash for income and business purposes.

In other words, lower wages and prices would lead to a reduction in the “transaction demand” for money, thereby increasing the amount of money available for “speculative purposes” (assuming the quantity of money in circulation to be constant) lowering proportionately the schedule of the “liquidity preference” for the community as a whole; in other words, the community will move down to pure liquidity preference schedule.

The lowering of the liquidity preference schedule will lower the rate of interest, and given the MEC will encourage investment, income, and employment. The greater the fall in wages and prices, the greater the quantity of money released from active balances to inactive balances and therefore the greater the fall in the rate of interest. This effect of low interest rate via wage reduction is called “Keynes Effect Proper”.

ADVERTISEMENTS:

If, however, the wage reductions were to result in social and political unrest, causing unfavorable effects on business expectations, the necessary encouragement to investment may not follow. Thus, the effects would vary according to circumstances and as far as pure theory was concerned, no definite conclusions could be arrived at, despite, a large body of economists came to regard “Keynes’ Effect” (lowering of interest rate via wage reductions) as a stimulant to investment. Thus, the theory that a reduction in the overall price level as a result of wage cuts leads to lower interest rates and therefore to increased investment is called ‘Keynes Effect Theory’ proper.

It is based on the following line of reasoning:

(i) Individuals establish a desired relationship between the money balances that they hold and their expenditures on goods and services,

(ii) Price reductions raise the real value of their money holdings,

ADVERTISEMENTS:

(iii) Thus, the desired relationship between real balances and expenditures is disturbed, and individuals come to possess an excess supply of liquid assets,

(iv) Individuals wish and are willing to lend part of this excess supply,

(v) An increase in the supply of funds in the loan market lowers the rate of interest,

(vi) With a lower rate of interest more investments take place.

ADVERTISEMENTS:

The Keynes’ effect operates only in the bonds market and as such it differs from the Pigou effect, which operates only in commodities market and from the real-balance effect, which operates in both the markets for bonds and for commodities.

It would be interesting to recall here the arguments of the classical economists’ that wage-cuts would restore full employment through a fall in the rate of interest and by eliminating unintended inventory accumulation. The Keynesians have rebutted this argument with the theory of liquidity preference. The fall in prices caused by wage cut will, to be sure, increase the real value of the money supply. But this is not likely to effect the rate of interest or the level of intended investment because in the liquidity trap the demand for money is infinitely elastic at the existing rate of interest.

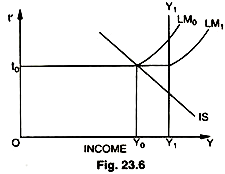

In the Fig. 23.6 the IS and LM0 intersection at Y0 is in the “liquidity trap range.” The rise in the real value of money supply acts to shift the LM curve from LM0 to LM1, but this obviously has no effect on the interest rate which remains the same at i0. The money balances that are released from transaction demands by the fall in the price level are hoarded by wealth holders who make no attempt to convert them into earning assets. The rate of interest as also the level of income remains constant at Y0. The Keynesians, therefore, believe that an underemployment equilibrium level of income such as Y0 may persist and that there is no automatic tendency for the economy to return to full employment.

Limitations of Keynes’ Effect:

(a) It is argued that if the rate of interest has already begun nearing the level, at which the schedule of liquidity preference becomes perfectly elastic, the fall in wages will have little or no effect on the interest rate. The cash released from transaction motive would be hoarded instead of being invested in securities and lowering the rate of interest as shown above.

(b) Further, wage reduction may fail to reduce the rate of Interest to desired levels along a given MEC on account of the “administrative costs” of borrowing and lending. Administrative costs include the costs of management of debt, inconvenience, risk and of altering the composition between cost and securities and different types of securities.

(c) Again, the marginal efficiency schedule may also shift downward to such low position that interest rates cannot be reduced enough or to that extent. It is just possible that MEC (which is taken as given) may fall so low that only negative rates of interest will suffice to stimulate investment.

(d) Moreover, even if it is conceded that the rate of interest is lowered via wage reductions, it is doubted if investment would be stimulated, for, it has been asserted that the MEC (which is equivalent to the demand schedule for funds for investment) is inelastic with respect to changes in interest rate. Investment, it has been asserted in recent times, is not only the function of the rate of interest (as emphasized by classicals) but depends upon MEC which further depends upon a large number of business and psychological factors.

(e) Lastly, Keynes took a more comprehensive (though not an exhaustive) view of the effects of wage reductions on employment and did not confine his analysis to lowering of interest rate via wage reduction (called Keynes Effect). He himself made the wise statement that used in this way, wage rates in effect become an instrument of money policy. He felt that same results could be achieved by appropriate monetary policy—that is, by manipulating and increasing the money supply.