Read this article to learn about the Pigou effect in commodities market of unemployment and its limitations.

Explanation of the Pigou Effect:

The Keynesian argument that the liquidity trap would prevent wage price flexibility from restoring full employment has not gone unchallenged.

The distinguished economists A.C. Pigou argued that even though the liquidity trap might bar the way to an increase in employment—via the path of changes in interest rates and investment—fall in wages and prices would sooner or later restore full employment because a decline in the price level would cause the consumption function to shift up.

The mechanism by which the consumption shifts up is commonly called the ‘Pigou Effect’.Thus, the essence of ‘Pigou Effect’ is that an overall reduction in the price level as a result of wage reduction leads to increased spending on goods and services.

ADVERTISEMENTS:

It is also based on the factors:

(i) That individuals hold money balances and spend them according to a desired ratio between them,

(ii) Fall in prices increases the real value of money holdings and these can now buy more,

(iii) The ratio between real balances and expenditures is disturbed because individuals have an excess supply of liquid assets,

ADVERTISEMENTS:

(iv) They spend a part of this excess supply on goods and services. We have already known that Pigou effect operates in commodities market only.

The Pigou Effect works as follows: Unemployment results in a fall of money wages which means lower costs and prices. The prices of assets like land, buildings, common stock shares are expected to fall along with other prices, so that there is no change in their real value. But a fall in price level means a rise in the real value of those assets the yield on which is fixed in rupee terms, like money, savings, deposit, bonds etc.

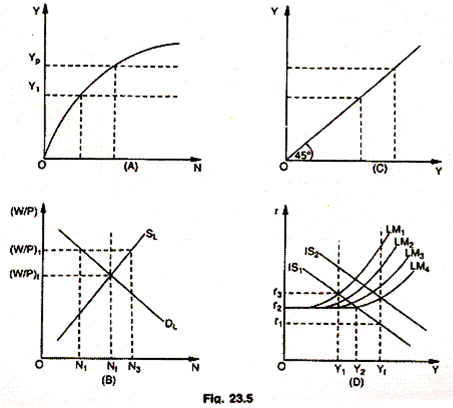

The increase in the real value of fixed income earning assets makes the wealth holders to spend more on consumption. It means an upward shift in the consumption function. This means a shift to the right of the IS curve and the IS curve rises from IS1 to IS2—a position that produces equilibrium level of income which is consistent with full employment as shown in part D of the Fig. 23.5.

Given LM4, a shift from IS1 to IS2 due to rise in consumption raises the level of real income from Y2 to Y1 or to full employment. We saw that in terms of Keynesian model, the income level of Yf could not be attained, through wage-price deflation (on account of the liquidity trap). His model did not allow for the Pigou effect, if it is included, wage and price flexibility appear to convert the Keynesian model into one with equilibrium only at full employment income level.

ADVERTISEMENTS:

Prof. A.C. Pigou introduced an additional variable into the classical saving function namely “the real value of cash balances”. Thus, S = F (r, Y, M/P), where r is the rate of interest, Y the level of income, M represents the quantity or the stock of money in circulation (consisting of government issued currency, government securities owned by consumers); P for the average price level or the cost of living index, so that M/P represents the “real value of cash balances”. According to Prof. Pigou there is a direct relation between the real value of liquid assets and the propensity to consume—this relationship has, been described as ‘Pigou Effect Proper’.

His main contention is that a fall in wages and prices will raise the “real value of cash balances” and other forms of accumulated savings (mainly government securities) and this will, in turn, lead to an increase in the propensity to consume, expanding investment and employment. Just as people spend more on consumption with a rise in the value of their liquid assets (by an expansion in the supply of money), so they consume more, if the value of their liquid assets is increased as a result of a fall in the price level. As the level of price falls, the real value of assets where prices are fixed in nominal term rises. A fall in the price level makes debtors worse off and creditors better off.

The magnitude of Pigou Effect is determined by the difference between the spending behaviour of debtors and creditors in response to a change in the price level. The reason for supposing that there is such a difference in the consumption responses to wealth changes is that the government is a large net debtor while the private sector, which holds a net balance of government obligations, is a net creditor. If; then, it is assumed that the marginal propensity of the government to spend wealth is zero while the marginal propensity to consume wealth is positive for the private sector, a transfer of wealth from one sector to the other due to a change in the price level will cause the level of total spending to change.

In brief, Pigou Effect implies a fall in wages and therefore, a fall in prices may lead to a rise in the real value of money assets effecting favourably propensity to consume. This contention is based on the assumption that as the real value of cash balances increases, lower becomes the desire to save out of real income. This is illustrated diagrammatically in the Fig. 23.7.

(a) Horizontal axis measures the saving and investment, and vertical axis the rate of interest.

(b) Saving function includes the real value of cash balances as an additional variable.

(c) Investment function is, however, assumed to be (or is accepted to be, or is taken to be) interest inelastic (to bring out the significance of the Pigou Effect clearly).

ADVERTISEMENTS:

(d) These S and I functions correspond to full employment level of income.

(e) Now, with a sufficient fall in money wages and prices, the real value of the constant stock of money increases, increasing the propensity to consume and decreasing the propensity to save (Pigou Effect Proper). The net result (as shown in the figure 23.7) is a shift in the saving schedule to the leftward from S and (showing a decline in savings). It intersects the investment schedule I at point E, corresponding to a positive rate of interest r0 (despite the fact that I curve is assumed to be interest inelastic).

(f) It is, therefore, clear that so long as the Pigou Effect proper is allowed to operate to the full extent of wage price flexibility, the theoretical possibility of an interest inelastic investment function need not obstruct an automatic full employment equilibrium. In other words, neither the institutional impossibility of a negative rate of interest nor a theoretical possibility of an interest inelastic investment function need obstruct an automatic full employment equilibrium, so long as Pigou Effect is allowed to operate to the full extent of wage price flexibility to the extent that Pigou effect can raise the income level in this way, it may be said that Pigou met Keynes on the latter’s own ground and won over him at least in theory, because Pigou effect invalidates the fundamental discovery of Keynes’ model—namely the possibility of underemployment equilibrium. But economists, on the whole, concede no such victory to Pigou and classical theory because Pigou effect has a number of limitations and is criticised on many grounds.

Limitations of Pigou Effect:

(a) Prof, K.K. Kurihara contends that falling wages and prices instead of increasing the propensity to consume may increase propensity to save. With wages and prices declining unchecked consumers’ overall asset position can be so adversely effected “as to strengthen their desire to add more to their assets and less to their consumption, especially if the real value of consumer durables and such nonmonetary assets is reduced much more than that of liquid assets is increased.” The individuals, who save, seem to be rather rare birds, just the kind of people whose appetite for saving would grow as their stock pile of liquid asset is increased. Pigou effect assumes too much about our knowledge on how an increase in the real value of money assets effects the propensity to save.

ADVERTISEMENTS:

(b) Moreover, Prof. Patinkin has stressed that “the stimulating effect of larger real cash balances on consumption may well be offset by the discouraging effect of increased debt burden (in real terms) on the consumption due to lower prices to leave the net effect very small, if any.”

(c) Again, Pigou Effect must be weighed quantitatively, i.e., we need to know how our money assets are distributed because Pigou Effect will depend upon the actual distribution of assets among different income groups and the extent to which the consumption function responds to an increase in the real value of liquid assets. The point to be remembered is that unless the lower income groups who are the real consumers own large money wealth (government securities, etc.) the Pigou Effect will have little importance if assets are ‘continued to be owned by wealthy individuals and financial institutions rather than by broader consuming public”.

Even if the Pigou Effect could prove quantitatively significant (i.e., even if we could ascertain how money assets are distributed) automatic full employment equilibrium might not be the necessary outcome of wage-price flexibility. This is exactly the position in underdeveloped countries having poor money and bill market, which are most disorganized. People do not have assets preference and do not possess securities, assets, or bills, so that when prices fall, Pigou Effect is almost nil (or very little) in such economies. This is reinforced by the findings of the Consumer Survey Institute, that only a comparatively small proportion of each of the lower income groups holds any appreciable amount of assets.

(d) Taking into consideration the short-term cycle effects viewed in terms of static analysis, let us assume that the reduction in wage cost has been completed, will the larger real value of money assets raise the consumption function, so that full employment can be ensured? The reply appears to be in the negative, since as recovery progresses, prices will begin to rise and so the real value of money assets will progressively fall. Instead of a reinforcing factor, the real asset effect, which is supposed to drive economy on to full employment, begins to vanish once the lower turning point in the cycle is reached.

ADVERTISEMENTS:

(e) Further, “on the basis of Keynesian Theory, it is possible to argue that reliance for stimulating effects of general wage reductions on consumption alone is bound to be self defeating, because the marginal propensity to consume is less than one. Thus, optimistic expectations on the part of businessmen induced by the general wage fall are inevitably disappointed, unless the wage-cuts stimulate investment as well as consumption. Any increase of output induced by a fall in wages will fall to generate enough consumption to absorb the entire increment in national income (as long as MPC is less than one).”

Thus, non-possession of money assets, and those who possess, their desire to possess still more, change of consumption in response to permanent wealth and presence of money illusion are factors which limit the utility of Pigou Effect, if any.